Advertisement|Remove ads.

Gold, Silver Touch Record Highs – Why Commodities Expert Ole Hansen Sees Possible Rotation Back Into Bullion

- The gold–silver ratio has held support near 49 for a fifth consecutive session, Hansen noted.

- Silver’s historic run will begin to test industrial demand, Hansen said in a post on X.

- Silver futures for March 2026 deliveries surged over 6% while gold futures for February 2026 deliveries jumped 3.5%.

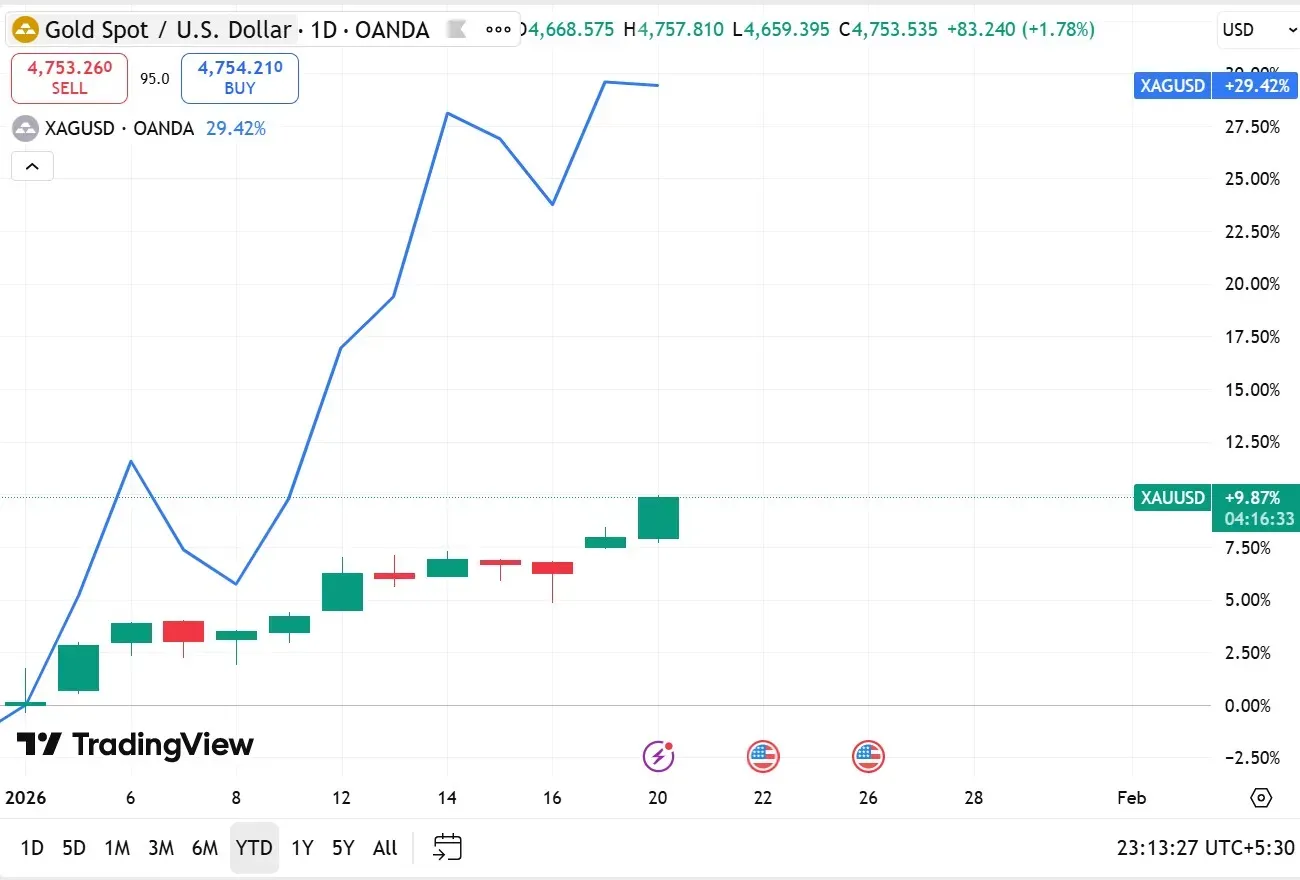

Precious metals extended their record-breaking rally into Tuesday, with silver surging past $95 an ounce for the first time ever and gold vaulting above $4,700, as investors rushed to safe-haven assets amid increasing geopolitical uncertainties.

Spot silver (XAG/USD) prices gained 1.6% to $95.9 an ounce, while spot gold (XAU/USD) rose 1.7% to $4751.4 per ounce. Futures showed stronger momentum as silver futures for March 2026 deliveries surged over 6% while gold futures for February 2026 deliveries jumped 3.5%.

The gold–silver ratio has held support near 49 for a fifth consecutive session, suggesting a possible rotation back into gold, said Ole Hansen, veteran commodities expert and Head of Commodity Strategy for Saxo Bank, in a post on X on Tuesday.

Silver’s historic run will begin to test industrial demand, which typically accounts for nearly 60% of total usage in a year, Hansen added.

Retail sentiment for SPDR Gold Shares ETF (GLD) turned ‘bullish’ from ‘neutral’ a day earlier, while iShares Silver Trust (SLV) remained in the ‘bullish’ territory at the time of writing.

Markets Watch

European and Asia-Pacific markets largely declined on Tuesday as investors weighed rising geopolitical risks after U.S. President Donald Trump threatened tariffs on goods from eight European countries unless a deal is reached for what he called the “complete and total purchase of Greenland.” Trump outlined 10% tariffs from February 1, rising to 25% by June.

U.S. equities fell on Tuesday, with the SPDR S&P 500 ETF (SPY) down by 1.4%, the Invesco QQQ Trust ETF (QQQ) fell 1.3%, while the SPDR Dow Jones Industrial Average ETF Trust (DIA) declined 1.2%

Meanwhile, Japanese government bond yields jumped after Prime Minister Sanae Takaichi called snap elections, pushing 10-year and 30-year yields sharply higher.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_circle_logo_original_jpg_93ebf851f7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2230137825_jpg_d14459f501.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2212184506_jpg_fda8936683.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Novo_Nordisk_jpg_96dd19f953.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1485519874_1_jpg_82b28a6517.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_Red_OG_jpg_d64521f99a.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)