Advertisement|Remove ads.

Goldman Sachs Bets Big On Credo Technology, Highlights High-Speed Copper Cables As Key Driver In Booming AI Data Center Market

- Analyst James Schneider highlighted Credo’s focus on short-distance, high-speed wired connectivity products used inside data centers.

- He also emphasized Credo’s role in advancing Active Electrical Cables, or AECs.

- The analyst believes that Credo’s vertically integrated model strengthens its competitive edge by allowing tighter control over design and production.

Goldman Sachs has launched coverage of Credo Technology Group Holding (CRDO) with a bullish stance, citing strong positioning in the fast-growing artificial intelligence data center market.

The firm assigned the semiconductor and connectivity company a ‘Buy’ rating and established a $165 price target, implying a potential 30% upside as of Wednesday’s closing price.

Why Goldman Is Optimistic

Analyst James Schneider highlighted Credo’s focus on short-distance, high-speed wired connectivity products used inside data centers, according to TheFly. According to a CNBC report, the company develops chips and cable systems that link advanced AI servers, an area experiencing rapid expansion as enterprises scale computing power.

Schneider emphasized Credo’s role in advancing Active Electrical Cables, or AECs, describing them as copper-based cables equipped with signal-enhancing components.

“AECs provide lower cost, high bandwidth connections with high reliability (no ‘link flaps’ or intermittent failures) relative to competing technologies for short-range datacenter connections, and we expect this technology to continue proliferating.”

-James Schneider, Analyst, Goldman Sachs

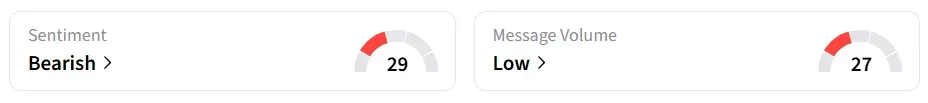

Credo stock traded over 1% higher onThursday morning. However, on Stocktwits, retail sentiment around the stock remained in ‘bearish’ territory amid ‘low’ message volume levels.

AI Data Centers Drive Demand

The surge in AI applications has fueled heavy investment in data infrastructure, benefiting suppliers of networking hardware. Schneider said that Credo’s vertically integrated model strengthens its competitive edge by allowing tighter control over design and production.

Goldman expects copper-based systems to remain widely adopted for several years. Schneider said he is “encouraged by Credo’s diversification efforts into optical solutions for datacenters that can help sustain long-term growth.”

CRDO stock has gained over 78% in the last 12 months.

Also See: Why Did Etsy Stock Jump 20% Pre-Market Today?

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_donald_trump_jpg_e07360ccae.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_jpg_eb6402d336.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_credo_technology_resized_cdb4311141.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228864541_jpg_d94770c5a8.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_joblessclaims_resized_jpg_b395b1ff15.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_cme_resized_5dbde36693.jpg)