Advertisement|Remove ads.

Goldman Sachs Hikes Price Target On Tesla: Analyst’s Q3 Delivery Estimate Now Exceeds Consensus

Goldman Sachs on Thursday raised its price target on Tesla (TSLA) to $395 from $300 while keeping a ‘Neutral’ rating on the shares ahead of the EV giant’s third-quarter (Q3) delivery report.

The new price target of $395 still represents a downside of about 7% from the stock’s closing price on Wednesday. The analyst raised its Q3 estimate for vehicle deliveries to 455,000 from 430,000, exceeding the consensus of 439,000, citing in part its global consumer survey data, as per TheFly. Goldman also increased its assumptions for the company's energy business in 2026 and 2027 to reflect recent product and capacity news.

The firm expects the company's earnings to grow in the long term due to contributions from autonomy and robotics. However, Goldman's base case expectation is for Tesla's profits in these areas to be more measured than the company is targeting.

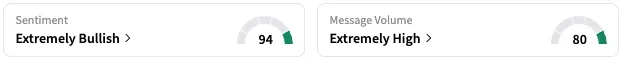

On Stocktwits, retail sentiment around TSLA stock stayed within ‘extremely bullish’ territory over the past 24 hours, while message volume stayed at ‘extremely high’ levels.

A Stocktwits user, however, sees the stock hitting $430.

“If Tesla can have outsized share in areas such as humanoid robotics and autonomy, then there could be upside to our price target, although if competition limits profits or Tesla does not execute well, then there could be downside,” the analyst said, as reported by CNBC.

Goldman also added that they attribute the better second-half delivery volumes in part to the recent Model Y L Launch in China, better consumer survey data, and in part to the expiry of the federal tax credit on the purchase of EVs on September 30.

In August, Tesla launched the Model Y L, a longer six-seater variant of its best-selling Model Y SUV, in China, the company’s second-largest market. Tesla CEO Elon Musk then said that the variant will not start production in the U.S. until the end of next year. The CEO also hinted that the company might not ever launch the variant in the U.S.

Tesla, on its website, is also urging customers in the U.S. to take delivery of their vehicles before September 30, when the federal tax credit of $7,500 on the purchase of new EVs will expire, raising the final price of the vehicle for consumers.

TSLA stock is up 5% this year and approximately 86% over the past 12 months.

Read also: Lyft Stock Hit With Multiple Price Target Hikes After Waymo Partnership: Check Out The New Levels

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2264020227_jpg_4d7420bef3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259210190_jpg_d48bbe3269.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1396534113_jpg_b0e09f299b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Jane_Street_3ac3fb6443.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Truth_social_5bfbc7389b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2221283194_jpg_8178c730a4.webp)