Advertisement|Remove ads.

Goldman Sachs’ Q4 Net Income More Than Doubles, Earnings Beat Wall Street Estimates: Retail Overjoyed

Shares of Goldman Sachs Group Inc (GS) rose nearly 5% on Wednesday after the bank’s fourth-quarter earnings topped Wall Street estimates by a wide margin.

The bank reported earnings per share (EPS) of $11.95 compared to a Wall Street estimate of $8.29. Revenue rose 23% year-over-year (YoY) to $13.87 billion versus an estimated $12.46 billion. The growth reflected higher net revenues across all segments, with significant growth in Global Banking & Markets.

Notably, Goldman Sachs’ net income more than doubled to $4.1 billion during the quarter. The bank’s net interest income (NII), the difference between interest earned and expended, surged over 75% YoY to $2.35 billion.

CEO David Solomon highlighted that the bank met or exceeded almost all of the targets set in its strategy to grow the firm five years ago.

During the quarter, the bank’s Global Banking & Markets division generated net revenues of $34.94 billion, driven by record net revenues in equities and strong performances in investment banking fees and Fixed Income, Currency, and Commodities (FICC). Investment banking fees rose 24% YoY to $2.05 billion.

Meanwhile, provision for credit losses stood at $351 million in Q4, compared with $577 million for the fourth quarter of 2023 and $397 million for the third quarter of 2024.

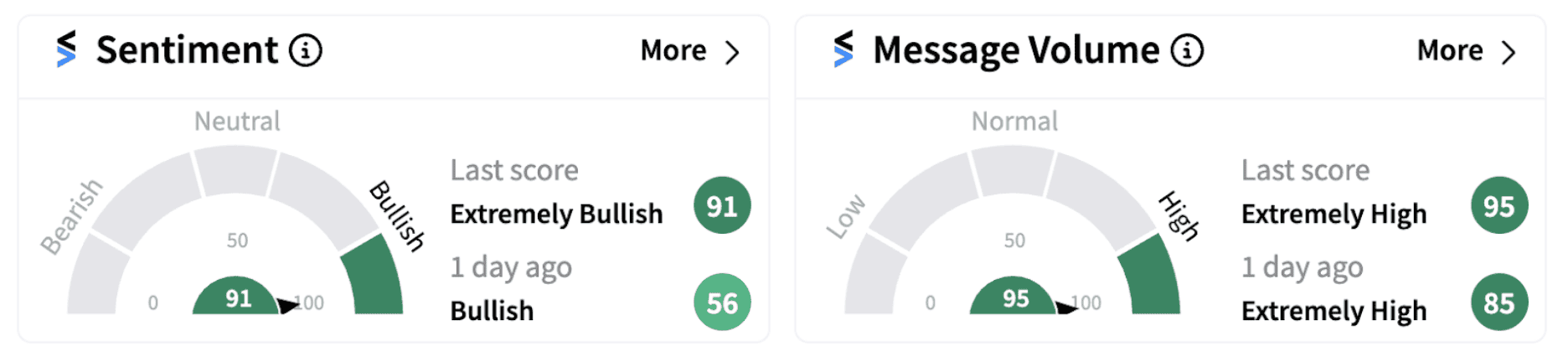

Following the earnings report, retail sentiment on Stocktwits jumped into the ‘extremely bullish’ territory (91/100) from ‘bullish’ a day ago. The move was accompanied by ‘extremely high’ retail chatter.

Stocktwits users expressed optimism about the shares’ prospects.

On Wednesday, JPMorgan Chase and Wells Fargo also reported positive earnings.

Notably, shares of Goldman Sachs have gained over 50% over the past year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_2026_4_jpg_bb96bc484b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2213366819_jpg_3e8b649e98.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2219715394_jpg_c787a7b591.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_martin_shkreli_jpg_4da92d4843.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263898051_jpg_9e75888009.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2241292402_jpg_9661b0c852.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)