Advertisement|Remove ads.

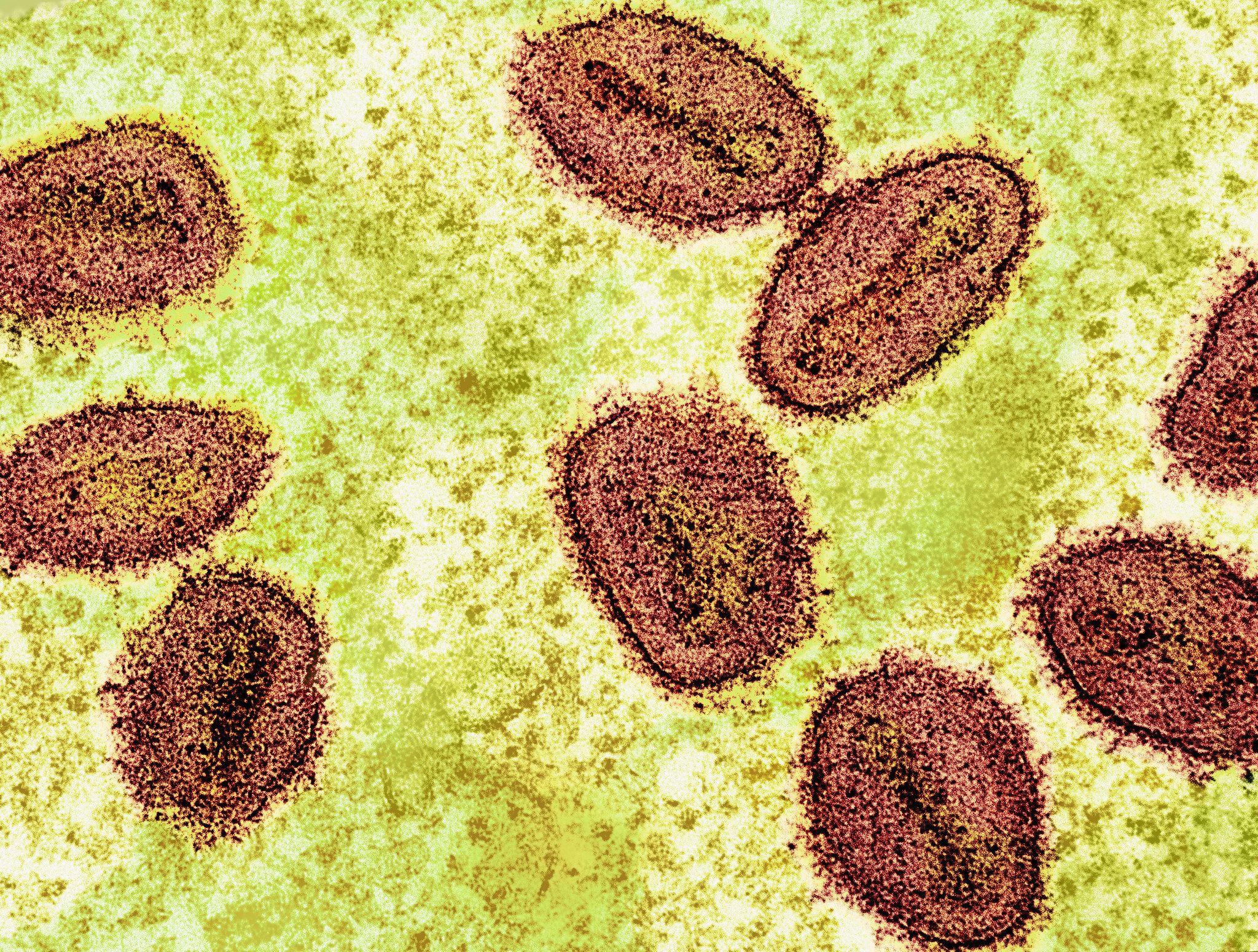

Emergent, Geovax, Tonix, Siga: Which Mpox-Linked Stocks Are Retail Investors Most Excited About?

The recent mpox outbreak has caused some worries, but has directed market attention toward U.S. vaccine and drug developers. Here's a breakdown of American pharma contenders grabbing the most retail investor interest over the past week:

GeoVax Labs Inc (GOVX): Having risen nearly 230% in a week, GOVX is the runaway leader in terms of gains. During the same period, the number of Stocktwits followers of the stock jumped 18% and message volume soared 5,216%.

However, the pre-market price tumbled on Tuesday after a share dilution agreement. While Geovax currently has no marketed products, it has published research suggesting its vaccines could combat mpox and expanded its license to include the virus in December 2023.

Additionally, brokerage Roth MKM reportedly believes Geovax's GEO-MVA vaccine could be the first product to market for mpox.

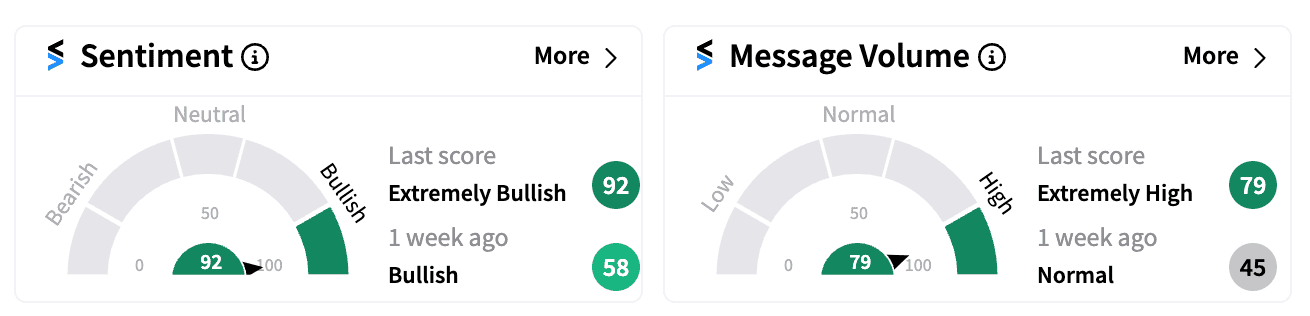

Emergent Biosolutions Inc (EBS): With 77% weekly gains, EBS has seen its Stocktwits sentiment shift to ‘extremely bullish’ (92/100) with high message volume, after the company responded to the WHO's call for vaccine manufacturers to submit its product for Emergency Use Listing (EUL) consideration.

“As the WHO has declared, the mpox outbreak is a public health emergency of international concern, and Emergent is ready to scale up response efforts and partner with U.S. and global public health leaders," said Emergent CEO Joe Papa.

Emergent's existing smallpox vaccine is used off-label for mpox, but a formal FDA approval for mpox use is pending.

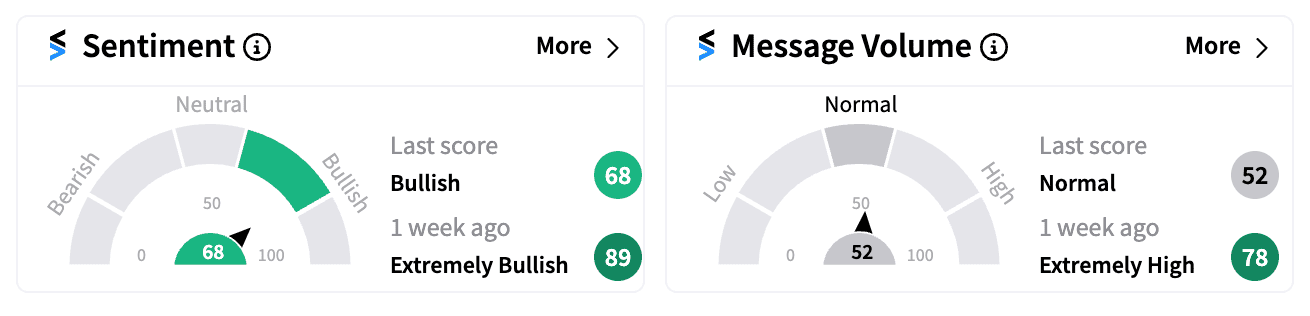

SIGA Technologies Inc (SIGA): SIGA is up 14% over the week, but has lost some momentum after its mpox drug failed to meet a primary study goal.

However, the company maintains the drug is available for use under compassionate use protocols. Retail sentiment remains ‘bullish’ (68/100) on Stocktwits, albeit lower than last week.

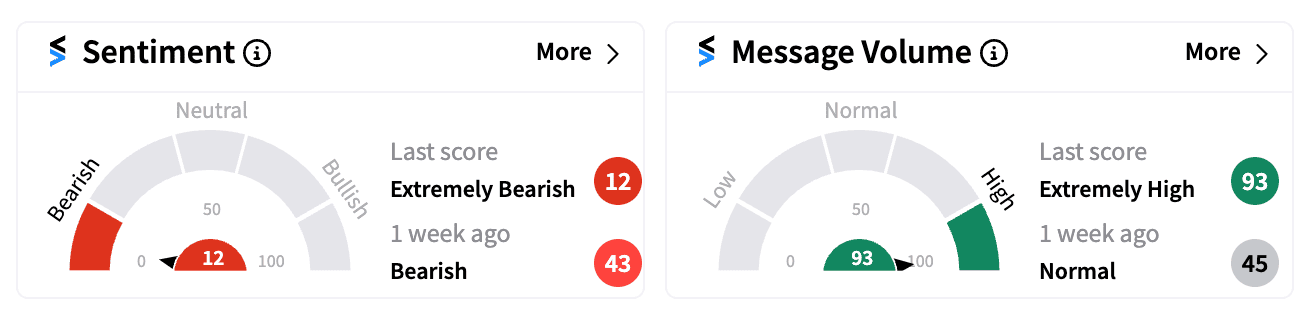

Tonix Pharmaceuticals Holding Corp (TNXP): Having declined 14% over the past week, TNXP has reiterated its commitment to develop its mpox vaccine, TNX-801.

However, a Q2 earnings miss and user pessimism on Stocktwits have driven sentiment into "extremely bearish" (12/100) territory.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2264020227_jpg_4d7420bef3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259210190_jpg_d48bbe3269.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1396534113_jpg_b0e09f299b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Jane_Street_3ac3fb6443.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Truth_social_5bfbc7389b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2221283194_jpg_8178c730a4.webp)