Advertisement|Remove ads.

Greenlight Capital’s David Einhorn Reportedly Builds Position In CNH Industrial Stock: Retail’s Playing It Carefully

Shares of agriculture-focused firm CNH Industrial ($CNH) jumped over 4% in Thursday’s pre-market session after a report stated Greenlight Capital’s David Einhorn has accumulated a medium-sized stake in the firm.

“It’s exactly the kind of situation that absolutely nobody cares about right now because it’s cheap, and the news over the next period of time isn’t going to be very good. Agriculture prices are low, and agricultural equipment is ending a down cycle,” Einhorn said at the CNBC’s Delivering Alpha conference, according to a report.

The hedge fund manager also noted that the firm is a significant dividend payer and is also repurchasing its stock actively. Talking about the cyclicality of the sector, Einhorn noted that demand is set to return as old equipment eventually has to be replaced.

“You had a period where you had a bit of a boom in agriculture equipment purchases, and now that’s turned into a cyclical bust. These things come and they go,” Einhorn said. “This year, the ag equipment universe is probably 20% below its average at the end of the whole recycle. And sometime three or four years from now, it’ll probably be 20% above. Just the nature of how these businesses work.”

CNH Industrial shares have lost over 17% so far this year. The company recently posted its third-quarter earnings report that saw its revenue decline 22% year-over-year (YoY) to $4.65 billion and net income fell 43% YoY to $310 million.

Contrary to Einhorn’s optimism, CNH Industrial appears to have a bleak outlook, at least for the near term.

The company said its forecast of continued weak industry retail demand in both the agriculture and construction equipment markets, coupled with elevated dealer inventories is requiring lower production levels.

“CNH will further reduce production output to manage channel inventory while continuing its efforts to improve through-cycle margins with its successful cost reduction programs. Due to the lower production levels, the company is revising its segment net sales and margins and its EPS results,” it said.

CNH lowered its 2024 outlook and now expects Agriculture segment net sales to decline between 22% and 23% YoY including currency translation effects (from down 15% to 20% previously). Adjusted diluted EPS is expected to come in between $1.05 to $1.15 (from between $1.30 to $1.40 previously).

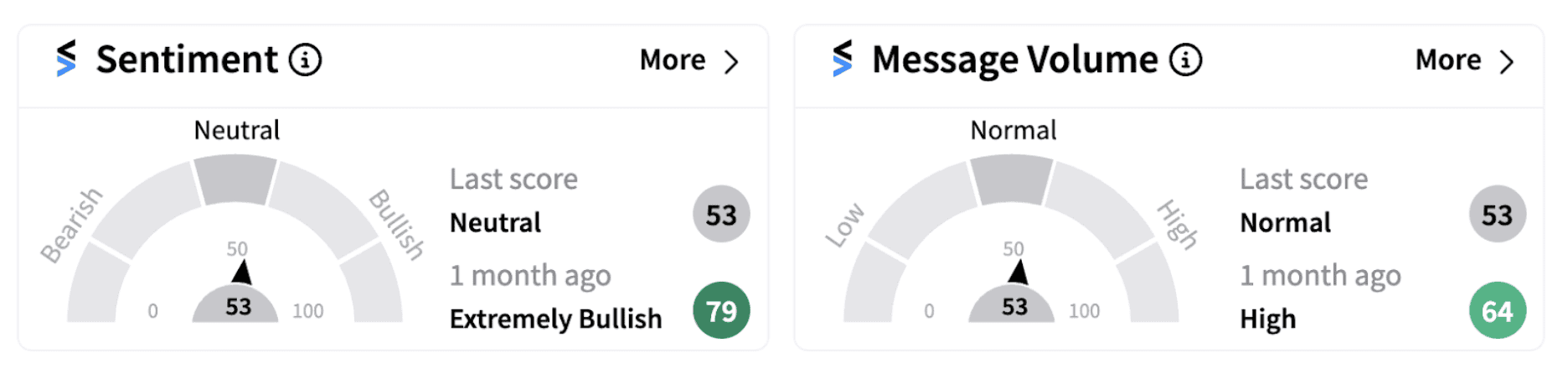

On Stocktwits, the sentiment meter has inched lower into the ‘neutral’ territory (53/100) before the bell on Thursday from ‘extremely bullish’ a month ago.

Retail investors are posting mixed takes on the stock despite the stake accumulation by Einhorn.

Also See: Zoomcar Holdings’ Stock Soars Pre-Market After Q2 Losses Narrow: Retail’s Cautiously Optimistic

For updates and corrections email newsroom@stocktwits.com

/filters:format(webp)https://news.stocktwits-cdn.com/large_Sharp_Link_Gaming_jpg_60ce5684e3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_new_york_stock_exchange_jpg_e1f85c0d8c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2243050664_jpg_37b52748e2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_hims_stock_logo_resized_jpg_5554a2a2c1.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Oil_drill_06147e8349.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2229019709_jpg_f82a27a246.webp)