Advertisement|Remove ads.

Grindr’s Q4 Beat Fails To Impress As Investors Fret Over Slower Revenue Growth Forecast For 2025: Retail Shrugs Off Stock Plunge

Shares of Grindr, Inc. (GRND), which operates social network and dating applications for the lesbian, gay, bisexual, transgender, and queer (LGBTQ) communities, fell sharply in Thursday’s premarket session.

The Los Angeles, California-based company reported a net loss of $124 million for the fourth quarter of the fiscal year 2024, wider than the year-ago loss of $45 million.

It noted that the most recent quarter’s results were weighed down by a $139 million non-cash loss from the change in the fair value of the warrant liability.

Grindr said it completed the redemption of all outstanding public and private warrants on Feb. 24. The change in the fair value of its warrant liability is adjusted at the end of each quarter to reflect the stock price at that time.

Revenue jumped 35% to $98 million, exceeding the Finchat-compiled consensus estimate of $97.10 million and the third quarter’s (Q3) 25% growth. Grindr noted that direct revenue from its core app products rose 28% to $80 million and indirect revenue from its advertising business soared 85% to $18 million.

The adjusted earnings before interest, taxes, depreciation and amortization (EBITDA) was $39 million versus last year’s $29 million. The adjusted EBITDA margin remained flat at 40%.

Among user metrics, average paying users jumped 15% YoY to $1.1 million, average monthly active users (MAUs) rose 7% to 14.2 million, and average revenue per paying user (ARPPU) increased 12% to $22.53.

Grindr said all user metrics reached record highs, reflecting the strength of its platform and continued engagement from its community.

The full-year revenue growth and the adjusted EBITDA margin hit the company’s guidance.

Grindr said its board authorized a two-year stock buyback program of up to $500 million of its common stock.

In a letter to shareholders, Grindr said, “2024 was an exceptional year, capped by a strong fourth quarter.”

“We exceeded our expectations on both top and bottom line, with sustained growth across key user metrics.”

Looking ahead, Grindr said it expects the adjusted EBITDA margin for the second half of 2025 to be stronger than in the first half.

The company guided to revenue growth of 24% for the fiscal year 2025, roughly aligned with the consensus estimate but marking a slowdown from 2024’s 29% growth, and an adjusted EBITDA margin of 41% or greater.

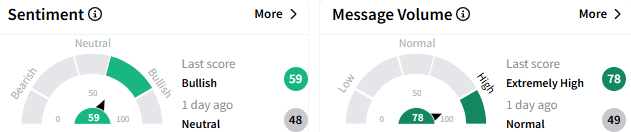

On Stocktwits, the retail sentiment toward Grindr stock moved to ‘bullish’ (59/100) from the ‘neutral’ mood seen a day ago. The message volume perked to ‘extremely high’ levels.

A retail watcher spoke of Grindr's solid fundamentals and its immunity to security situations or inflation. “This is a great opportunity,” they said.

Another user attributed the post-earnings weakness to manipulation by short sellers. According to Yahoo Finance data, the short percent of the float was 18.83% as of Feb. 14.

In premarket trading, Grindr stock plunged 8.40% to $17.12, the lowest level since Jan. 23. The stock has gained roughly 5% so far this year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2203138957_jpg_dd735f9905.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2195701587_jpg_dde6526b92.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_core_scientific_coreweave_OG_jpg_58f1ea2dbf.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2255969940_jpg_0903b745a1.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2218181288_jpg_d22b8a81ff.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ryanair_michael_oleary_jpg_d2a378f59e.webp)