Advertisement|Remove ads.

GRSE Stock At Crossroads After 200% Rally: SEBI RA Sudhansu Panda Says ₹2,570 Is Crucial For Direction

Garden Reach Shipbuilders & Engineers (GRSE) witnessed an exceptional rally earlier this year, surging nearly 200% between May 9 and June 23.

However, technical signals suggest the momentum has cooled off, noted SEBI-registered analyst Sudhansu Sekhar Panda of Bluemoon Research.

After reaching the ₹3,500 level, GRSE stock pulled back to ₹2,900, and then staged a rebound to retest ₹3,500. However, the second attempt to break past this resistance was met with strong selling pressure, causing the stock to slide back to ₹2,900. This price action resulted in a classic double top formation on the daily chart, Panda said.

After failing to sustain above the neckline, the stock slipped sharply and is now consolidating just below the ₹2,570 and ₹2,660 range.

At the time of writing, GRSE shares were trading 1.87% lower at 2,566.6.

He sees immediate support near ₹2,570. If this level breaks decisively, the next downside targets could be ₹2,400 and ₹2,200.

On the flip side, a move above ₹2,660 may trigger a short-term bounce toward ₹2,730 - ₹2,800, he added.

Despite the recent decline, GRSE remains a fundamentally strong defence stock, having benefitted from rising order flows and sectoral tailwinds over the last few quarters. The current pullback appears to be profit booking after a steep run-up, the analyst said.

While short-term volatility is expected, long-term investors should keep an eye on the ₹3,500 zone as a potential breakout level if the stock resumes its upward trajectory.

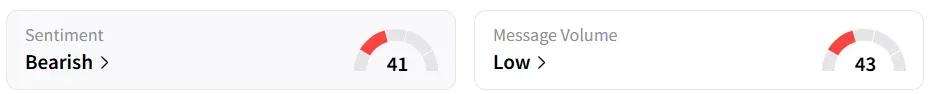

Retail sentiment on Stocktwits remained ‘bearish’, implying further downside. It was ‘neutral’ a month ago.

Year-to-date, the stock has gained nearly 60%. However, profit booking over the past month has led to a 20% decline during that period.

For updates and corrections, email newsroom[at]stocktwits[dot]com

/filters:format(webp)https://news.stocktwits-cdn.com/large_Solana_722b6a3879.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_X_Elon_Musk_274c6a8683.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_kevin_o_leary_OG_jpg_2789641a97.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2200882557_jpg_53f3e467bc.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2260269284_jpg_cf42b9b8c3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Patrick_Witt_d5f3eaa4da.webp)