Advertisement|Remove ads.

Guess Sees Short Covering After Deal Chatter — Retail Bullishness Fades Fast

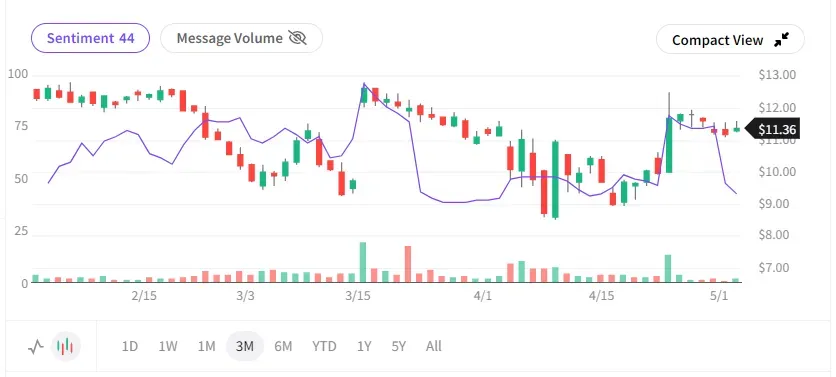

Short interest in Guess? Inc. eased this week as investors reacted to renewed takeover speculation, though shares of the apparel retailer slipped amid broader market gains.

According to Ortex data compiled by The Fly, short interest as a percentage of Guess’s free float fell by seven percentage points to 34.3%, while days to cover dipped from 5.9 to 5.7.

The pullback follows last Thursday’s sharp rally, when shares climbed 17% after a Bloomberg report said Authentic Brands Group is considering a competing bid for Guess.

Authentic Brands is weighing an offer to rival WHP Global’s $13-per-share all-cash proposal, which was made in March, according to people familiar with the matter. Deliberations are ongoing, and no final decision has been made.

Shares of Guess closed the April 25 session at $11.64, valuing the company at roughly $603 million, after surging 17% on news that Authentic Brands may launch a competing bid.

Despite the brief rally, the stock fell 7% last week and remains down 19% year-to-date.

On Stocktwits, retail sentiment surged to 74 after the Bloomberg report — signaling strong bullishness on the platform’s 0–100 scale — but has since cooled to 44, reflecting a shift back into ‘bearish’ territory amid fading deal enthusiasm.

Some traders suggested the company would be a strong strategic fit within Authentic Brands' portfolio and speculated on a potential upside to $15 for the stock if a deal materializes.

Others noted that Guess shares are trading near five-year lows and argued that the company remains profitable, with limited downside risk below $10.

Guess announced in April that it had formed a special committee of independent directors to evaluate WHP’s bid.

That offer involves some current shareholders, including co-founders Paul and Maurice Marciano, rolling over their stakes.

The potential for a rival bid has added uncertainty and renewed attention to corporate governance concerns.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_tariffs_jpg_d7661eb31a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227347257_jpg_81c3539d3f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2204003106_jpg_405e036a7c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ondas_OG_jpg_05cf209e61.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_peter_tuchman_jpg_fb781e7355.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262920033_jpg_f596c67fd3.webp)