Advertisement|Remove ads.

Gujarat Gas Trading Above Key Averages: SEBI RA Mayank Gupta Flags ₹480 Breakout Trigger

Gujarat Gas is building technical strength, with a 4% gain over the last month and growing momentum on the charts.

According to SEBI-registered analyst Mayank Gupta, the stock is trading above all major moving averages: 25-day, 50-day, 100-day, and 200-day, indicating a steady uptrend and strong support from the broader market structure.

The Relative Strength Index (RSI) is around 55, indicating that the stock is neither overbought nor oversold and remains uptrend.

Gupta highlights that if the stock closes above ₹480, it would signal a range breakout, potentially leading to a significant upward move.

The important support level is identified near ₹445, which could serve as a cushion in case of any pullback.

The fundamental backdrop is relatively stable. The city-gas distribution company reported a marginal decline in revenue for the March quarter, with topline figures at ₹4,102 crore. However, operational performance has improved.

Analysts expect volume growth to continue in the medium to long term, backed by rising industrial gas consumption and supportive regulatory policies.

Brokerage views, however, remain divided. Global investment firm CLSA has maintained its ‘Underperform’ rating with a target price of ₹385, implying an 18% downside.

On the other hand, JM Financial remains bullish, reiterating a ‘Buy’ call with a target of ₹580, which suggests a 24% upside from current levels.

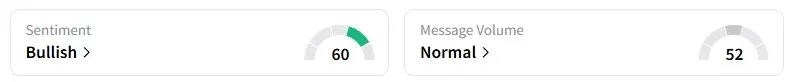

Retail sentiment has also turned optimistic. Data from Stocktwits shows that traders on the platform have shifted to a ’bullish’ stance on Gujarat Gas over the past week.

Gujarat Gas shares have fallen 7% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_adam_smigielski_K5m_Pt_O_Nmp_HM_unsplash_f365ee93f4.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1190665957_jpg_92088206ed.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2235337192_jpg_56c00409cf.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_marvell_logo_OG_jpg_dfc748dd9b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2232147590_jpg_a31aecbfad.webp)