Advertisement|Remove ads.

Harry Potter, DC Universe, And Game Of Thrones Will Now Be A Part Of Netflix

- Netflix will take over Warner Bros.’ film and television studios, along with HBO Max and HBO.

- The streaming giant will secure beloved franchises like Game of Thrones, Harry Potter, and the DC Universe.

- Legendary characters such as Batman, Superman, Wonder Woman, and Looney Tunes icons will be owned by Netflix.

Netflix Inc.’s (NFLX) landmark agreement to acquire the studio and streaming assets of Warner Bros. Discovery, Inc. (WBD), is expected to give the streaming giant a hold over some of Hollywood’s most celebrated franchises, including Harry Potter and DC Universe.

The deal, valued at roughly $83 billion, was finalized after Netflix outbid competitors, including Paramount Skydance, and Comcast, in a heated bidding war for WBD’s entertainment properties.

Expanding Entertainment Reach

Netflix will acquire Warner Bros.’ film and television studios, along with HBO Max and HBO, granting the platform access to a massive library of popular shows and movies, thereby enhancing its global content offerings.

This union merges Netflix’s global reach and streaming expertise with Warner Bros.’ century-long legacy, bringing beloved franchises such as Game of Thrones, Harry Potter, The Big Bang Theory, The Sopranos, the DC Universe, and The Wizard of Oz, along with Netflix originals, under one roof.

Netflix’s stock traded over 3% lower in Friday’s premarket.

Strategic Advantages

Netflix plans to keep Warner Bros.’ existing operations running and enhance its key areas, including movie theater releases. The acquisition will proceed following the planned spin-off of WBD’s Global Networks division, Discovery Global, which is expected to be completed in the third quarter of 2026.

With this takeover, Netflix gains control over legendary characters such as Batman, Superman, Wonder Woman, and Looney Tunes icons, as well as high-value properties like the Conjuring Universe and Mortal Kombat films.

What Are Stocktwits Users Saying?

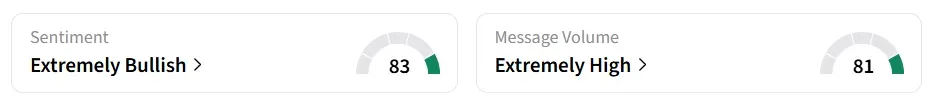

On Stocktwits, retail sentiment around Netflix stock jumped to ‘extremely bullish’ from ‘neutral’ territory the previous day amid ‘extremely high’ message volume levels.

A bullish Stocktwits user expressed optimism about Netflix’s subscriber growth.

Another user said they have added to their existing position.

NFLX stock has gained over 15% year-to-date and over 12% in the last 12 months.

Also See: ITT Stock Dips Premarket After Striking $4.7 Billion Deal For SPX FLOW

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_microstrategy_michael_saylor_resized_9fd19e69ec.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262651778_jpg_54075aa1d9.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_ibm_signage_mwc_resized_28f91e1a63.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_circle_stablecoins_original_jpg_b238d12be8.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_US_stocks_3e2253bcca.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Revised_Profile_JPG_0e0afdf5e2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2209881066_jpg_ebc4b9b217.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)