Advertisement|Remove ads.

Solana Company Stock Rockets 169% After Firm Raises $500M To Make SOL Its Primary Treasury Asset: Retail Cheers The Deal

Shares of Solana Company (HSDT) jumped on Monday after the neurotech company announced the pricing of an oversubscribed $500 million private investment in public equity (PIPE) offering, led by Pantera Capital and Summer Capital.

The transaction also includes $750 million in potential funding through stapled warrants, exercisable at $10.134 per share for a period of three years, with the shares priced at $6.881. The closing is expected on or around September 18, subject to customary conditions.

Proceeds from the deal will fund Solana Co.’s new digital asset treasury strategy, anchored by Solana (SOL), the native token of the Solana blockchain. SOL will serve as the company’s primary treasury reserve asset. Solana Co plans to acquire SOL in the open market and establish dedicated treasury operations, while continuing to allocate funds to working capital and general corporate purposes.

The company expects to significantly scale its SOL holdings over the next 12–24 months and will evaluate opportunities to generate yield through staking, lending, and broader decentralized finance activities.

The strategy will be overseen by incoming Executive Chairman Joseph Chee, Founder of Summer Capital and former Head of Investment Banking Asia at UBS, alongside Cosmo Jiang, General Partner at Pantera Capital, as Board Observer, and Dan Morehead, Founder and Managing Partner of Pantera, as Strategic Advisor.

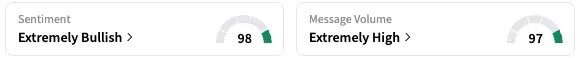

On Stocktwits, retail sentiment around HSDT stock stayed within ‘extremely bullish’ territory over the past 24 hours, while message volume stayed at ‘extremely high’ levels. Shares of the company jumped 169% at the time of writing.

A Stocktwits user cheered the announcement.

HSDT stock is down by 96% this year.

Read also: Tesla, Alphabet, Intel, BitMine, Nvidia: Stocks Making The Biggest Moves Today

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Editor's Note: The story has been updated to reflect the firm's change of name to Solana Company.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Core_Weave_jpg_b1a99c6298.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2243572319_jpg_90770a5e51.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Truth_Social_logo_1200_Px_resized_jpg_86883cac04.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2243387433_jpg_9712a99e81.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227049575_jpg_fe5b82901f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)