Advertisement|Remove ads.

Here’s Why Shuttle Pharma is the Most Undervalued Biotech Stock in Our Coverage Universe

Valuation discrepancies in the biotech sector highlight Shuttle Pharma’s incredible potential. With several peer companies in Phase 2 trials boasting market caps of over $500 million, Shuttle's valuation stands at just $4 million.

- Radiation therapy is a cornerstone of cancer treatment, with approximately 50% of cancer patients undergoing it during their illness. A sensitizer is a drug designed to enhance the effectiveness of radiation by making cancer cells more susceptible to damage while sparing healthy cells. This approach revolutionizes therapy by increasing tumor control and minimizing harmful side effects, particularly for aggressive cancers like glioblastoma. Shuttle Pharma’s Ropidoxuridine is at the forefront of this innovation.

- Valuation discrepancies in the biotech sector highlight Shuttle Pharma’s incredible potential. While several peer companies in Phase 2 trials boast market caps exceeding $500 million, Shuttle’s valuation stands at just $4 million. This mismatch reflects a significant opportunity for investors, as Shuttle is already enrolling patients in its Phase 2 trial for Ropidoxuridine.

- Founded by Georgetown University faculty, Shuttle Pharma is led by experienced scientists and executives with decades of oncology expertise. The management team includes individuals responsible for bringing successful cancer therapies to market, further bolstering its credibility.

Shuttle Pharmaceuticals: Revolutionizing Radiation Therapy by Making it More Effective at Killing Cancer Cells while Sparing Healthy Cells

Shuttle Pharmaceuticals (NASDAQ: SHPH) is a clinical-stage biotech company specializing in therapies that enhance the efficacy of radiation therapy while minimizing side effects. Beyond Ropidoxuridine, Shuttle Pharma’s pipeline includes promising candidates like SP-2-225 and SP-1-303, along with diagnostic tools that could streamline FDA approval and open additional revenue streams.

Dr. Anatoly Dritschilo, the company’s CEO, brings decades of experience as a radiation oncology leader and professor at Georgetown University. His tenure at the institution has cemented his reputation as an innovator in radiosensitization and therapeutic resistance strategies.

Hope for Those Facing a Ruthless Cancer

Glioblastoma (GBM) is one of the deadliest cancers, with a five-year survival rate of just 6.9% and an average survival of eight months. It impacts cognition, mood, and independence, placing emotional and financial burdens on patients and families. With only a handful of FDA-approved treatments, GBM remains a significant challenge, but innovations like Shuttle Pharma’s Ropidoxuridine offer hope for better outcomes.

Pipeline Overview and Flagship Drug

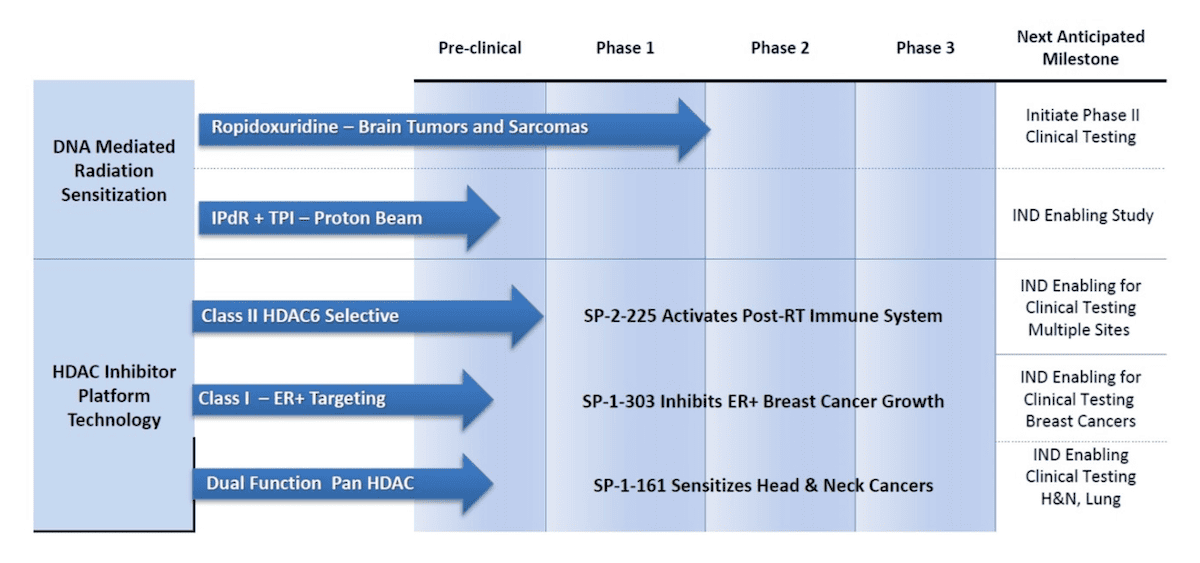

Shuttle Pharma’s pipeline includes:

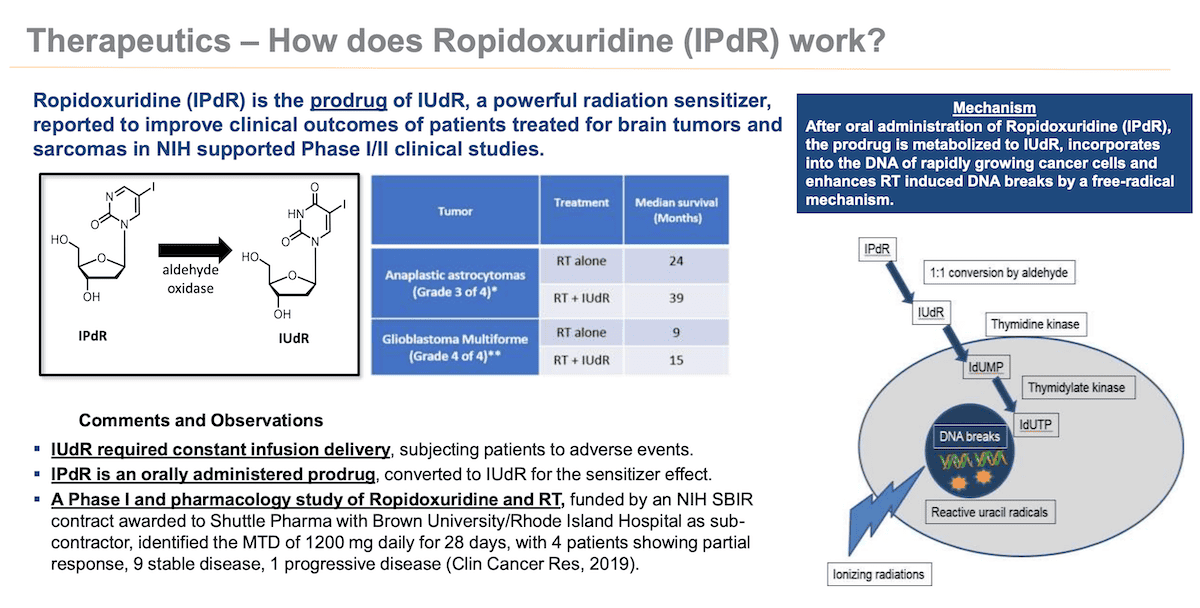

- Ropidoxuridine (IPdR): Their flagship radiation sensitizer in Phase 2 trials for glioblastoma. As a sensitizer, it enhances the vulnerability of cancer cells to radiation while sparing healthy tissues, leading to improved therapeutic outcomes. The drug has received an Orphan Drug Designation, ensuring market exclusivity upon approval (3). Early data supports its safety and oral bioavailability, with promising mechanisms to sensitize cancer cells without harming normal tissues.

- SP-2-225: A preclinical HDAC6 inhibitor targeting immune activation post-RT. HDAC6 inhibitors are emerging as a transformative class of drugs with the potential to improve tumor recognition by the immune system (4). This drug could have broad applications combined with radiation therapy and other immune therapies, addressing a large oncology market.

- SP-1-303: Another preclinical asset targeting estrogen receptor-positive breast cancers, a subtype that represents a significant portion of all breast cancer diagnoses. Its unique mechanism of action and potential synergy with current hormonal treatments create substantial commercial potential.

Market Potential for Ropidoxuridine and Other Candidates

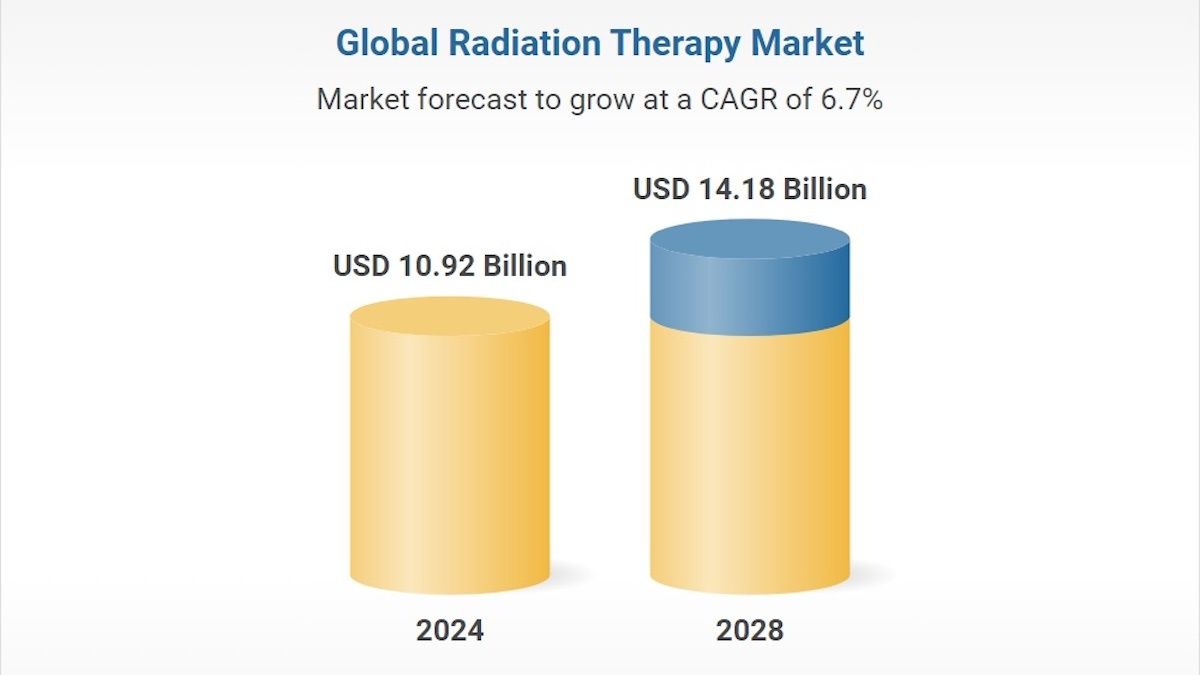

Radiation sensitizers represent a multi-billion-dollar opportunity. The global radiation therapy market is projected to grow significantly, reaching $14.18 billion by 2028 (2). Approximately 50% of all cancer patients undergo radiation therapy, amounting to a substantial number of patients annually in the US alone (1). A significant portion of these patients are treated with curative intent, offering a target market potentially worth billions for sensitizing agents.

With glioblastoma as the initial target, Shuttle’s technology could eventually expand into other cancer types where radiation is a core treatment modality, such as lung, breast, and gastrointestinal cancers. By reducing radiation toxicity and improving tumor control, Ropidoxuridine could become an essential adjunct to standard cancer care.

Simple Mechanism of Action and Proven Safety

Ropidoxuridine acts as a prodrug, metabolized into IUdR upon ingestion. IUdR incorporates into cancer DNA, enhancing RT-induced DNA damage while sparing healthy cells.

In layman’s terms, Ropidoxuridine is like a “homing beacon” for radiation therapy, guiding the radiation to attack cancer cells while avoiding healthy tissues. This straightforward and targeted approach significantly increases the likelihood of clinical success compared to more complex therapies.

Comparative Analysis: Valuation vs. Peers

Biotech valuations often evolve significantly as companies progress through clinical trials. For Phase 1 assets, the average valuation tends to hover between $100 – $250 million, while Phase 2 assets range from $250 – $750 million (5). Currently valued at approximately $4 million, Shuttle Pharma is an outlier, suggesting it should be 25x higher based on similar Phase 2 comparables. If Ropidoxuridine demonstrates efficacy, the company could see valuations 100x higher, reflecting the upside potential.

Similar Stage Comparisons: Phase 2 Enrollment

Leap Therapeutics (NASDAQ: LPTX)

- Market Cap: Approximately $82 million

- Focus: Antibody-based therapies targeting immune modulation in cancer.

- Pipeline: DKN-01, currently in Phase 2 for gastric and gynecologic cancers (4).

- Comparison Insight: Leap Therapeutics commands a valuation over 20x that of Shuttle Pharma, underscoring the latter’s deep undervaluation relative to its stage of development.

- Market Cap: Approximately $23 million

- Focus: Immune therapies targeting novel tumor-specific antigens.

- Pipeline: NC318, currently in Phase 2 trials for advanced solid tumors.

- Comparison Insight: NextCure reflects the market’s optimism for immune-oncology therapies in Phase 2 trials.

- Demonstrated Efficacy Comparisons: Post-Positive Phase 2

- Market Cap: Approximately $620 million

- Focus: Precision oncology for genetically defined cancers.

- Pipeline: Tipifarnib, demonstrating efficacy in Phase 2 for HRAS-mutant cancers (6).

- Comparison Insight: Kura highlights the potential valuation growth when efficacy is shown in Phase 2 for a targeted therapeutic.

- Market Cap: Approximately $76 million

- Focus: Allogeneic gamma-delta T cell therapies for oncology.

- Pipeline: ADI-001, demonstrating Phase 2 efficacy in B-cell lymphomas.

- Comparison Insight: Adicet underscores how valuation grows post-efficacy, aligning with Shuttle Pharma’s potential trajectory.

An Accomplished Team Backed by Prestigious Institutions

Shuttle Pharma’s leadership is grounded in expertise, with key team members boasting extensive experience in oncology drug development:

- Dr. Anatoly Dritschilo: CEO and co-founder, a globally recognized radiation oncology expert with over 40 years of experience. Dr. Dritschilo has published extensively on radiation therapy and drug discovery and is an innovator in developing strategies for radiosensitization and therapeutic resistance.

- Dr. Tyvin Rich: Medical Director with experience at MD Anderson and Harvard, specializing in radiation sensitizers.

- Dr. Mira Jung: Scientific Director and co-founder, a professor of Radiation Medicine at Georgetown University.

The rest of the team comprises an impressive roster of PhDs, MDs, and industry veterans with decades of combined experience developing oncology therapies and navigating FDA regulatory pathways.

Strong Insider Ownership and Shareholder Alignment

With 28.3% insider ownership, including a significant investment from the CEO, Shuttle Pharma’s management is deeply aligned with shareholder interests. This rare level of insider ownership reflects confidence in the company’s potential. High insider ownership ensures that decision-makers have “skin in the game,” aligning their financial interests with investors and creating trust in long-term value creation. Additionally, if clinical data supports efficacy, the small public float (2.9 million shares) positions the stock for dramatic price appreciation.

Conclusion: The Undervalued Biotech to Watch

Shuttle Pharma’s small float, strong leadership, and groundbreaking focus on radiation sensitizers position it as one of the most undervalued opportunities in biotech. With a Phase 2 trial underway and a massive addressable market, Shuttle could redefine cancer treatment while offering exponential upside for investors. Comparisons to higher-valued peers only underscore the gap—and the potential for rapid revaluation if results prove successful.

Shuttle Pharma’s other drug candidates, including SP-2-225 and SP-1-303, offer compelling bonuses for investors. These unique yet complementary assets could potentially expand Shuttle’s market reach in oncology. Additionally, the company’s diagnostic tools present a unique opportunity: they often have more streamlined FDA approval processes than therapeutics and could potentially be spun off as a standalone business, unlocking significant shareholder value.

References

- American Cancer Society: Radiation Therapy Overview

- Global Radiation Therapy Market Report

- FDA Orphan Drug Designation List

- Leap Therapeutics Corporate Pipeline

- Biotech Valuation Trends

- Kura Oncology: Pipeline

This report/release/profile is a commercial advertisement and is for general information purposes only. We are engaged in the business of marketing and advertising companies for monetary compensation unless otherwise stated below.

Wealthy VC and its employees are not Registered Investment Advisors, Broker-Dealers or a member of any association for other research providers in any jurisdiction whatsoever and we are not qualified to give financial advice. The information contained herein is based on sources which we believe to be reliable but is not guaranteed by us as being accurate and does not purport to be a complete statement or summary of the available data. Wealthy VC encourages readers and investors to supplement the information in these reports with independent research and other professional advice. All information on featured companies is provided by the companies profiled through their website, news releases, and corporate filings, or is available from public sources and Wealthy VC makes no representations, warranties or guarantees as to the accuracy or completeness of the disclosure by the profiled companies. Our website and newsletter are for entertainment purposes only. This website is NOT a source of unbiased information. Never invest in any stock featured on our site or emails unless you can afford to lose your entire investment.

Release of Liability: Through the use of this email and/or website advertisement, by viewing or using it, you agree to hold Wealthy VC, its operators, owners and employees harmless and to completely release them from any and all liability due to any and all loss (monetary or otherwise), damage (monetary or otherwise), or injury (monetary or otherwise) that you may incur. Wealthy VC-sponsored advertisements do not purport to provide an analysis of any company’s financial position, operations or prospects and this is not to be construed as a recommendation by Wealthy VC or an offer or solicitation to buy or sell any security. WealthyVC and our controlling entity 1000724287 Ontario Ltd have been compensated USD $7,500 per month for six months for investor relations by Shuttle Pharmaceuticals Holdings, Inc.

None of the materials or advertisements herein constitute offers or solicitations to purchase or sell securities of the companies profiled herein and any decision to invest in any such company or other financial decisions should not be made based upon the information provided herein. Instead, Wealthy VC strongly urges you to conduct a complete and independent investigation of the respective companies and consideration of all pertinent risks. Readers are advised to review SEC periodic reports: Forms 10-Q, 10K, Form 8-K, insider reports, Forms 3, 4, 5 Schedule 13D and all reports published on SEDAR if the company featured is Canadian. Wealthy VC further urges you to consult your own independent tax, business, financial and investment advisors. Investing in micro-cap and growth securities is highly speculative and carries an extremely high degree of risk. It is possible that an investor’s investment may be lost or impaired due to the speculative nature of the companies profiled.

The Private Securities Litigation Reform Act of 1995 provides investors with a ‘safe harbor’ in regard to forward-looking statements. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, goals, assumptions or future events or performance are not statements of historical fact and may be “forward-looking statements”. Forward-looking statements are based on expectations, estimates, and projections at the time the statements are made that involve a number of risks and uncertainties which could cause actual results or events to differ materially from those presently anticipated. Forward-looking statements in this action may be identified through the use of words such as “projects”, “foresee”, “expects”, “will”, “anticipates”, “estimates”, “believes”, “understands”, or that by statements indicating certain actions “may”, “could”, or “might” occur. Understand there is no guarantee past performance will be indicative of future results. Past Performance is based on the security’s previous day’s closing price and the high of-day price during our promotional coverage.

In preparing this publication, Wealthy VC has relied upon information supplied by various public sources and press releases which it believes to be reliable; however, such reliability cannot be guaranteed. Investors should not rely on the information contained in this email and website. Rather, investors should use the information contained in this website as a starting point for doing additional independent research on the featured companies. The advertisements in this email and website are believed to be reliable, however, Wealthy VC and its owners, affiliates, subsidiaries, officers, directors, representatives and agents disclaim any liability as to the completeness or accuracy of the information contained in any advertisement and for any omissions of material facts from such advertisement. Wealthy VC is not responsible for any claims made by the companies advertised herein, nor is Wealthy VC responsible for any other promotional firm, its program or its structure.

This article was written by an independent contributor and does not reflect the views of Stocktwits. It has not been edited for content. The information provided here is intended solely for informational and educational purposes, and should not be interpreted as investment advice. Stocktwits does not endorse the purchase or sale of any security nor does it make any claims about the financial status of any company.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250993932_jpg_77e7b26c88.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_tesla_cybertruck_jpg_7f6ed70b80.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Workday_logo_resized_d2d5258f05.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Lucid_jpg_221b9d07ec.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2222819201_jpg_edcbb1336e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Novo_Nordisk_jpg_96dd19f953.webp)