Advertisement|Remove ads.

Hexcel Stock Gains After Posting Q4 Profit, Retail’s bullish

Hexcel Corp (HXL) shares rose 3% on Thursday after the company posted a quarterly profit compared to a year-ago loss.

On Wednesday, the materials supplier posted a net income of $5.8 million for the quarter ended Dec. 31, compared with a loss of $18.2 million last year.

Hexcel’s net sales rose 3.6% to $473.8 million but slightly fell short of the Wall Street estimate of $477 million, according to Koyfin data.

The company said Commercial Aerospace sales rose 4% to $278.3 million, with modest growth in Airbus A320neo and Boeing 787 sales. However, Boeing 737 MAX sales were lower year over year.

Its adjusted net income of $0.52 per share came in line with market expectations.

Sales in its space and defense segment rose 7.2% to $163.3 million, with strong growth with the Sikorsky CH-53K and Lockheed F-35 aircraft.

The company, one of the biggest suppliers of carbon fiber to aircraft companies, forecasts 2025 sales in the range of $1.95 billion to $2.05 billion.

Hexcel also forecast adjusted earnings from $2.05 to $2.25 per share.

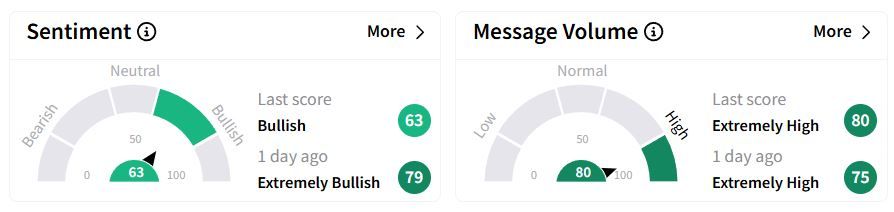

Retail sentiment on Stocktwits moved to ‘bullish’ (63/100) territory from ‘extremely bullish’(79/100) a day ago, while message volume remained ‘extremely high.’

Over the past year, stock is down 2%.

Also See: GE Aerospace Stock Surges Premarket After Upbeat Q4 Profit, $7B Buyback: Retail Sentiment Takes Off

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_micahel_saylor_OG_3_jpg_4f304c479d.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_rivian_automotive_jpg_e356c1abe5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2252871865_jpg_74865c27a7.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_jpg_eb6402d336.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_OG_3_jpg_94334765ec.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ondas_OG_jpg_05cf209e61.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)