Advertisement|Remove ads.

Hims & Hers Hits New Highs On At-Home Lab Testing Plans: Retail Sees More Room To Run, Analysts Divided

Hims & Hers Health, Inc. shares surged 17.5% on Wednesday, marking their best performance in a week and hitting fresh highs once again.

The telehealth firm announced plans to introduce at-home lab testing, a move that has fueled the stock’s red-hot rally and boosted retail investor sentiment.

The company has acquired New Jersey-based Sigmund NJ, which operates as Trybe Labs, to support at-home blood draws and whole-body testing. The acquisition was funded with cash on hand, and Hims & Hers expects to roll out the service over the next year.

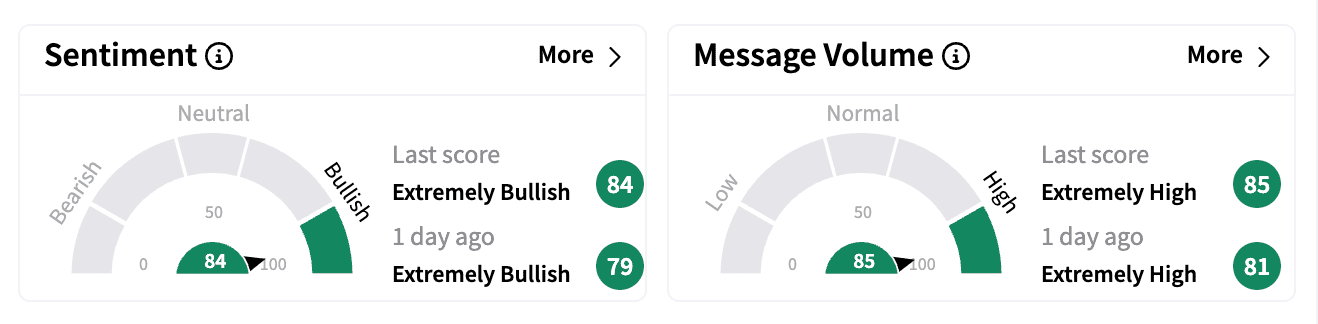

Retail enthusiasm has soared, with Stocktwits sentiment turning even more ‘extremely bullish’. Message volume jumped over 150% on Wednesday, as investors celebrated the stock’s gains.

Hims & Hers is now on track for its sixth consecutive week of gains.

One user shared that they had sold a portion of their holdings for “life-changing money” but remained bullish on the stock’s future.

Another labeled Hims & Hers as “the Netflix of healthcare” as the company expands its services.

Screenshots of long positions flooded Stocktwits, with many traders hopeful the stock will soon hit $100.

Wall Street analysts remain somewhat divided on the stock’s outlook.

According to The Fly, BTIG analyst David Larsen raised the firm’s price target to $85 from $35, maintaining a ‘Buy’ rating.

Larsen cited strong demand in the obesity health market, the confirmation of Robert F. Kennedy Jr. as Health and Human Services Secretary, and a strengthening economy as key drivers.

The analyst believes a generic version of semaglutide would favor Hims & Hers and highlighted that 50% of members use personalized solutions, reinforcing its strong long-term growth potential.

Canaccord also raised its price target, increasing it to $68 from $38 while maintaining a ‘Buy’ rating. The firm noted that shares are up more than 140% year-to-date, thanks in part to a successful Super Bowl ad and expected regulatory tailwinds.

However, Canaccord warned that elevated growth expectations could lead to near-term volatility as the company introduces its FY25 guidance.

Visibility into the ongoing semaglutide shortage remains limited, but the firm believes personalized dosing and regulatory tailwinds will help Hims & Hers continue compounding growth beyond the shortage.

Morgan Stanley analyst Craig Hettenbach took a more cautious approach, downgrading Hims & Hers to ‘Equal Weight’ from ‘Overweight’ while still raising the price target to $60 from $42.

Hettenbach acknowledged the company’s strong business momentum but argued that its rapid rise is now fully priced into the stock. He warned that volatility surrounding weight loss drug developments could create opportunities in both directions, suggesting the stock is due for a “breather after a torrid run.”

Hims & Hers is set to report fourth-quarter earnings next week, with Wall Street expecting an adjusted profit of $0.10 per share on revenue of $469.68 million.

Short interest in the stock has spiked from 19.7% at the start of the year to 26.6% by the end of January, according to Koyfin data.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_robert_kiyosaki_d28a01cb4b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_and_Ethereum_2b4356b70a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_976546456_jpg_42ddd4a81d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259655311_jpg_20124bbeb9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Donald_Trump_451371e34e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228736233_jpg_f3ebe80a4c.webp)