Advertisement|Remove ads.

Hims & Hers Stock: More Gains Ahead Or A Pullback? Most Retail Traders Bet On This Path

Hims & Hers Health Inc. has been on a meteoric rise, with shares soaring over 145% this year and more than sixfold in the past 12 months.

But as the stock breaches fresh record highs, investors are slightly divided on whether the rally has more room to run — or if a pullback is imminent.

The telehealth provider's stock trades at a lofty 136 times trailing earnings and 64 times estimated 2025 earnings, reflecting heightened expectations for its expansion into the booming obesity drug market.

Its recent Super Bowl ad has amplified the conversation. The commercial, which has amassed nearly 250,000 views on YouTube, criticizes the weight-loss industry and positions Hims' compounded alternatives as "doctor-trusted" and "life-changing." However, it has also drawn regulatory scrutiny.

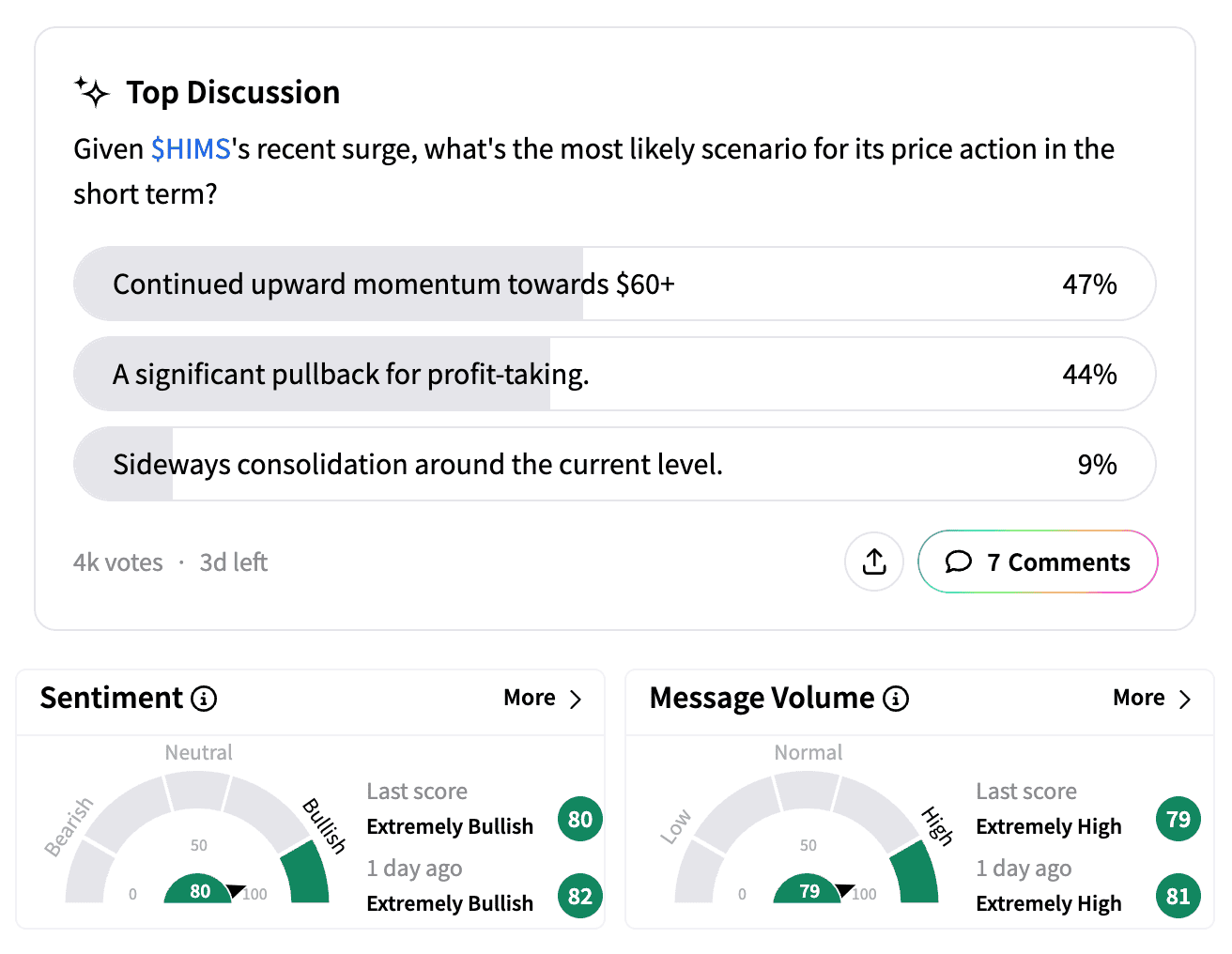

A Stocktwits poll of over 4,000 respondents found that 47% believe the stock will continue its climb past $60, while 44% expect a significant pullback for profit-taking.

Message volume on the platform has surged more than 700% over the past month, and the stock's retail following has grown by 17% to over 27,000 followers.

Hims initially made its name selling hair loss and sexual health treatments before entering the weight-loss drug market last year with compounded semaglutide, an alternative to Novo Nordisk's drugs. The FDA allows such sales only during a national shortage.

Mizuho analysts reportedly suggest the company might have an ally in newly confirmed Health and Human Services Secretary Robert F. Kennedy Jr.

"Our sense ... is that the RFK-led HHS will take a fairly lenient stance with respect to compounders when it comes to weight-loss drugs ... provided the drugs are seen as safe," the research firm said.

With fourth-quarter earnings due in two weeks, Wall Street expects Hims to post an adjusted profit of $0.10 per share on revenue of $469.68 million.

One user on the platform predicted strong earnings for Hims, saying, "No one is gonna pull out before that or before $100/share. I think we will see a $0.27 EPS, a 125% beat over expectations."

Another user commented on the company's marketing impact, noting, "Amazing what an 8 million dollar Super Bowl ad will do."

According to Koyfin data, short interest in Hims' stock spiked from 19.7% at the start of the year to 26.6% by the end of January.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2209881066_jpg_ebc4b9b217.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_us_japan_jpg_5a4a8c1f81.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227931078_jpg_7ccfff654b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2221559761_jpg_71120b5aaa.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Robotaxi_Tesla_jpg_209f017098.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_AT_and_T_store_resized_542005da9b.jpg)