Advertisement|Remove ads.

Hims & Hers Stock Up Ahead of Earnings: Retail Sentiment Upbeat

Telehealth company Hims & Hers Health Inc.’s ($HIMS) stock was up 2.4% in afternoon trading on Monday ahead of the company’s third-quarter earnings.

Wall Street analysts expect Q3 earnings per share (EPS) to clock at $0.10 on revenue of $382.2 million. Wall Street is looking for signs of continuing demand for telehealth and wellness services.

HIMS has beaten analyst estimates three times in the last four quarters.

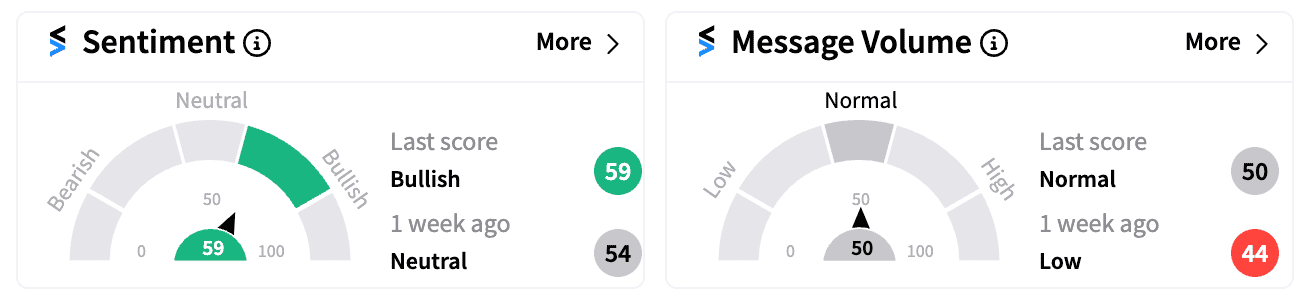

Retail sentiment on the stock turned ‘bullish’ (59/100) from ‘neutral’ (50/100) a week ago, while message volumes returned to the normal zone from low.

The company’s stock came under pressure recently after Eli Lilly posted a decline in GLP-1 revenue due to stock shortages and increasing competitive pressures, raising concerns about the sustainability of these medications that are also part of HIM’s offerings.

Additionally, Hims & Hers sells a compounded version of semaglutide, the active ingredient in Novo Nordisk’s Ozempic and Wegovy, as an alternative to those drugs. Should the FDA update its shortage list to exclude Novo Nordisk’s flagship drugs, Hims & Hers will no longer be able to sell its version. That looming threat continues to weigh on the stock ahead of results, where investors hope management will provide additional color on the situation.

In Q2, the company reported EPS of $0.06, beating estimates by nearly 43.78%. Its revenues stood at $315.65 million, 3.61% above estimates. Its subscribers in Q2 grew 43% to 1.9 million, compared to the previous year.

"Our second quarter results mark an acceleration in what was already an incredible trajectory. During the quarter, subscribers on our platform approached 1.9 million, increasing 43% year-over-year," Andrew Dudum, co-founder and CEO, said in a statement at the time.

Some Stocktwits users were bullish on the prospects for the company’s stock.

HIMS stock has more than doubled year-to-date.

For updates and corrections, email newsroom@stocktwits.com

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_HPE_office_with_logo_resized_c15b2ba0d3.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_stock_market_fall_generic_jpg_f7dffafa95.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2219201937_jpg_67aaff68c1.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2213366819_jpg_3e8b649e98.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1445160636_jpg_9759816169.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_stock_price_rising_OG_jpg_5f141f956f.webp)