Advertisement|Remove ads.

Hindalco Shares: SEBI RA Sees Recovery Potential Despite Copper Tariff Jitters

Shares of copper-related companies remain in the spotlight following a warning from US President Donald Trump about a 50% copper import tax, which led to investor uncertainty and concerns about demand.

Hindalco shares witnessed notable pressure in Wednesday’s trade and are trading flat at the time of writing.

SEBI-registered analyst Deepak Pal sees signs of recovery in Hindalco if it sustains above key support levels.

Its Relative Strength Index stood near 51, and Moving Average Convergence Divergence (MACD) remains above the signal line, showing mild strength.

Pal noted that despite short-term downside risk, the stock is holding firmly above its 55-day EMA, indicating potential support. For medium-term investors, any dip around current levels could present a good buying opportunity with a stop-loss of ₹650. If strength sustains, Hindalco stock may retest ₹725–730 levels in the coming sessions.

He also highlighted that with rising demand for aluminium across sectors like EVs, renewables, and infrastructure, Hindalco is well-positioned for long-term growth.

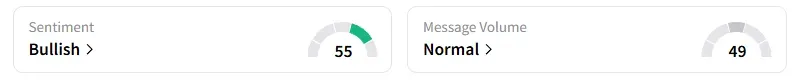

Data on Stocktwits shows that retail sentiment is ‘bullish’ on this counter.

Hindalco shares have gained 12% year-to-date (YTD).

Hindalco, a flagship company of the Aditya Birla Group, is one of the world’s largest aluminium and copper manufacturing companies.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262161352_jpg_832967dbca.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_OG_oct23_jpg_588046d0a9.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_patrick_soon_shiong_jpg_5f4d6bc18d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2246431195_jpg_539619e6b1.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262983094_jpg_2896f12e4a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2033244575_jpg_3f112039eb.webp)