Advertisement|Remove ads.

Hindustan Copper May See Nearly 10% Upside Despite Near-Term Bearish Signals: SEBI RA Deepak Pal

Hindustan Copper has been under heavy selling pressure recently, declining nearly 7% over the past week. The stock was placed under an F&O ban on July 10.

Additionally, copper stocks have been under pressure this week following US President Donald Trump's announcement of a 50% tariff on copper imports.

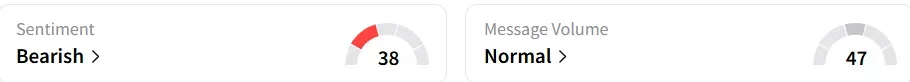

The stock’s retail sentiment on Stocktwits shifted from ‘bullish’ to ‘bearish’ a week ago.

On the daily chart, the formation of a large bearish candle signals further short-term profit booking, noted SEBI-registered analyst Deepak Pal.

Technically, the stock continues to trade above its 14-day and 50-day exponential moving averages (EMA), suggesting the broader trend remains intact, despite trading close to key support zones.

The Parabolic SAR has flipped to a bearish stance, while the moving average convergence/divergence (MACD) indicates weakening momentum. The relative strength index (RSI) stands at 51.84, reflecting a neutral position, Pal said.

Hindustan Copper’s shares are expected to find support near the ₹255 - ₹260 zone, and a bounce from this level could offer short-term trading opportunities, the analyst said.

For medium-term investors, Pal recommended taking up positions at current levels with targets of ₹285 - ₹290, while cautioning a stoploss at ₹250.

The stock is currently trading at ₹264.40, having gained 6.9% year-to-date (YTD).

The state-run firm enjoys a monopoly in copper mining and benefits from the rising demand driven by the government’s focus on infrastructure and renewables.

While the company consistently generates revenue and maintains low debt, its profitability remains sensitive to fluctuations in global copper prices, high costs, and operational inefficiencies.

Ongoing capacity expansion projects and strong promoter holding position the company well for long-term growth, though short-term volatility may persist, the analyst added.

For updates and corrections, email newsroom[at]stocktwits[dot]com

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_eli_lilly_logo_resized_9e8a8a2333.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_celsiusholdings_resized_jpg_5617397fa8.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Ethereum_OG_jpg_d3e6e5843b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2226817028_jpg_d2fd9156db.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_elerian_resized_jpg_49303b41ee.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_netflix_paramount_warner_bros_jpg_c959c8a9e4.webp)