Advertisement|Remove ads.

Home Depot Stock Rises On Q4 Earnings Beat Despite Uncertain Macro Conditions: Retail’s Extremely Bullish

Shares of Home Depot rose 0.4% in after-hours trading Tuesday after gaining 3% in the regular session following the home improvement retailer’s better-than-expected fourth-quarter results amid higher interest rates and macro challenges, lifting retail sentiment.

Home Depot’s fourth-quarter earnings per share came in at $3.13, beating estimates of $3.04. Revenue stood at $39.7 billion, surpassing Wall Street’s expected figure of $39.25 billion.

Comparable sales for the fourth quarter of fiscal 2024 increased 0.8%, and comparable sales in the U.S. increased 1.3%.

CFO Richard McPhail told CNBC that “housing is still frozen by mortgage rates” but the company saw broad-based growth, with sales improving in about half of its merchandise categories and a majority of its U.S. geographies.

For 2025, it projected total sales growth of about 2.8%, comparable sales growth of about 1.0% and plans to open 13 new stores.

However, adjusted earnings per share is projected to decline about 2% from last year.

“Our fourth quarter results exceeded our expectations as we saw greater engagement in home improvement spend, despite ongoing pressure on large remodeling projects,” said Ted Decker, chair, president and CEO. “Throughout the year, we remained steadfast in our investments across our strategic initiatives to position ourselves for continued success, despite uncertain macroeconomic conditions and a higher interest rate environment that impacted home improvement demand.”

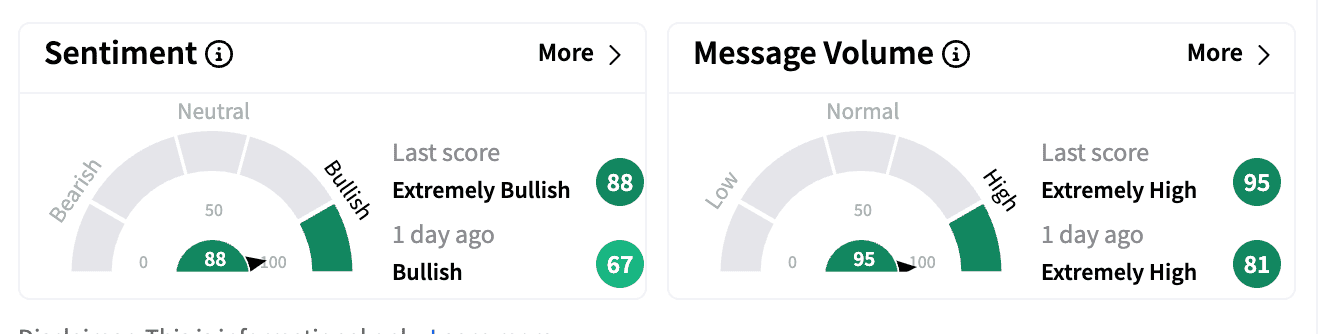

Sentiment on Stocktwits improved to ‘extremely bullish’ from ‘bullish’ a day ago. Message volume inched up in the ‘extremely high’ territory.

Its board approved a 2.2% increase in its quarterly dividend to $2.30 per share, equating to an annual dividend of $9.20 per share. The dividend is payable on March 27, 2025, to shareholders of record on the close of business on March 13.

Home Depot operated a total of 2,347 retail stores and over 780 branches across the US and its international locations.

Home Depot stock is up 1.1% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1247400381_jpg_765e6ec016.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Black_Rock_Bitcoin_ETF_IBIT_f66b744bfc.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_kraken_2091850a33.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_wall_street_resized1_jpg_7f200ce842.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2215666275_jpg_07d03239b9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_2026_2_jpg_a7bbca2bde.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)