Advertisement|Remove ads.

Honda And Nissan Officially Call Off Merger Plan: Stocks Rise, But Retail Sentiment Diverges

There were murmurs in the market initially, but now it’s official: Japanese giants Honda and Nissan have confirmed they’ve scrapped their proposed merger, which would have formed the third-largest automaker globally by sales.

A company statement on Thursday revealed that after signing the memorandum of understanding (MOU) in December, the management teams — including the CEOs — engaged in discussions to assess the market environment, integration objectives, and post-merger strategies.

Honda had proposed a revised structure, suggesting that Honda would be the parent company with Nissan as a subsidiary, a shift from the initial plan to establish a joint holding company.

However, both companies agreed that, given the volatile market conditions and the push toward electrification, it would be more effective to cease discussions and terminate the MOU.

Honda and Nissan plan to continue their strategic partnership, focusing on intelligent and electrified vehicles.

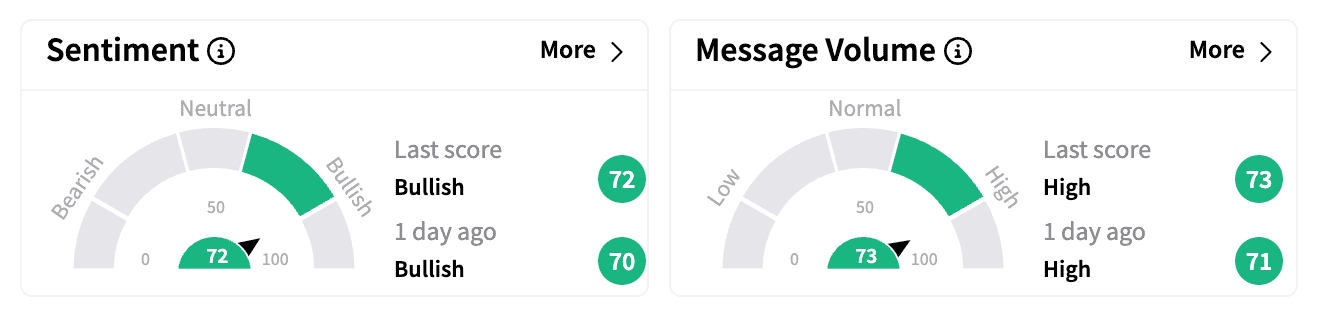

U.S.-listed shares of Honda rose nearly 2% on the news, with Stocktwits sentiment showing a ‘bullish’ score.

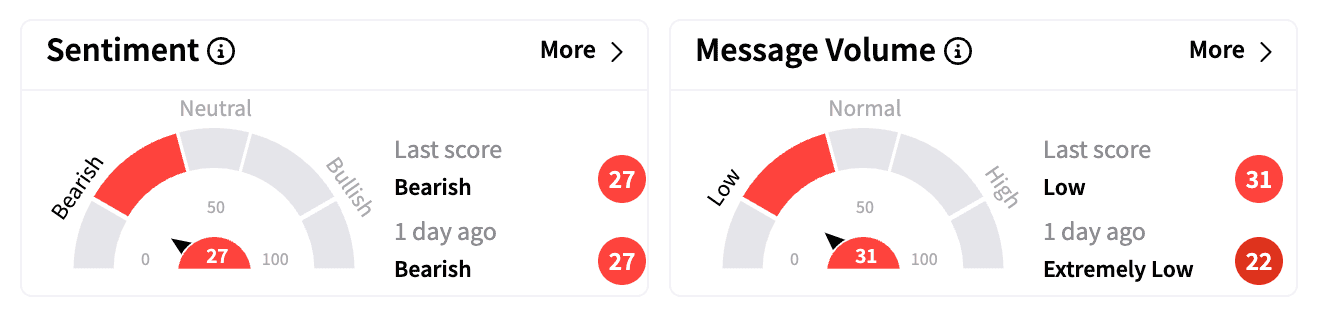

Meanwhile, Nissan’s shares jumped as much as 5%, before paring gains, although retail traders remained skeptical about the stock.

The brief rally was fueled by a Bloomberg report indicating that private equity firm KKR is considering investing in Nissan to bolster the company’s financial standing.

However, the potential deal remains uncertain, as KKR may ultimately choose not to proceed, according to the report.

Retail skepticism likely stems from concerns the rumor will fall through. Last week, reports suggested Taiwan’s Foxconn was considering a stake in Nissan after rumors surfaced that the Honda deal was in trouble.

However, Foxconn chairman Young Liu clarified on Wednesday that the focus is on cooperating with Nissan’s largest shareholder, Renault, which owns 36% of the Japanese firm.

On Thursday, Reuters reported that Nissan reported a sharp drop in third-quarter profit and lowered its full-year forecast for the third time.

The company announced plans to cut costs by about 400 billion yen ($2.6 billion) in fiscal 2026 by reducing labor costs and restructuring its manufacturing base.

So far this year, Nissan’s shares have lost more than 7%, while Honda’s shares have dipped around 1.5%.

(1 Japanese yen = $0.0065)

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227669377_jpg_9a115c3623.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227231004_jpg_0de480c6f4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2254924041_jpg_892ccf911d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1234736300_jpg_881ee00045.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2218899763_jpg_5d8b51f97d.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trump_golden_dome_resized_jpg_38d699de1f.webp)