Advertisement|Remove ads.

Honda-Nissan Merger Talks In Jeopardy? Retail Buzz Picks Up As Report Fuels Doubts

Retail investor chatter climbed on Stocktwits early Wednesday as reports surfaced that Nissan’s board plans to reject Honda’s proposed merger terms.

The Wall Street Journal, citing sources familiar with the discussions, reported that while no final decision has been made, Nissan is expected to oppose Honda’s revised structure.

The new plan reportedly would have made Nissan a subsidiary of Honda rather than both companies merging under a single holding company.

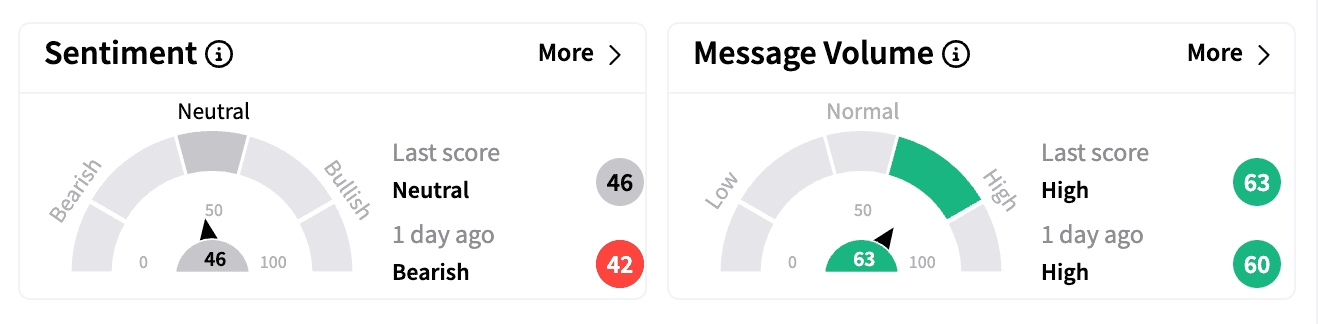

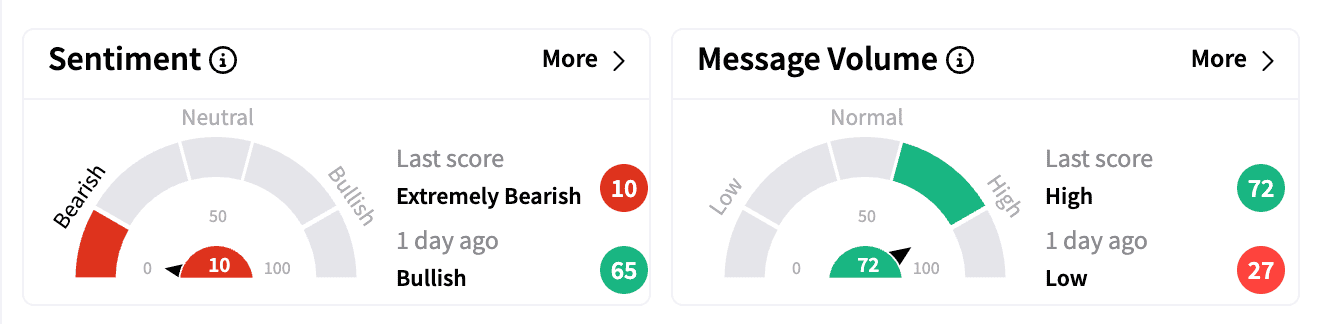

Stocktwits data showed a ‘neutral’ reading for Honda, while Nissan’s sentiment flipped to ‘extremely bearish,’ with message volumes climbing for both automakers.

Most retail investors were still digesting the news.

When Honda and Nissan first announced their merger discussions in December, the plan was to form a joint holding company, with both firms operating as subsidiaries and possibly including Mitsubishi.

However, both companies have been losing market share in China, where domestic electric vehicle manufacturers have gained dominance.

Nissan, in particular, has faced more profound financial struggles compared to its rivals, making the merger a critical strategic move.

Together, Honda and Nissan reportedly sold over 2.3 million vehicles in the U.S. last year, making them two of the most prominent foreign auto brands in the country.

Market reaction to the latest developments was swift. Nissan’s stock plunged more than 4% on the Tokyo Stock Exchange, while Honda surged over 8%, suggesting that investors believe Nissan has more to lose if the deal falls apart.

In U.S. premarket trading, Nissan’s stock was down over 1%, while Honda climbed more than 5%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227669377_jpg_9a115c3623.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227231004_jpg_0de480c6f4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2254924041_jpg_892ccf911d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1234736300_jpg_881ee00045.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2218899763_jpg_5d8b51f97d.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trump_golden_dome_resized_jpg_38d699de1f.webp)