Advertisement|Remove ads.

Honda, Nissan Stocks Climb On Report Of Merger Talk To Battle EV Giants: Retail Is Intrigued

U.S.-listed shares of Honda Motor Co., and Nissan Motor Co. rose on Tuesday afternoon following a report from Nikkei that the two Japanese automakers are in merger discussions.

According to the report, the companies are considering forming a holding company to combine resources and better compete with industry leaders such as Tesla and Chinese electric vehicle (EV) giants BYD, Nio, and Xpeng.

The merger talks are expected to lead to the signing of a memorandum of understanding soon.

The plan could reportedly include the eventual integration of Mitsubishi Motors, where Nissan holds a 24% stake, into the new entity. This would create one of the largest auto groups in the world.

However, details about the ownership stakes of Honda and Nissan within the holding company and its governance structure are still under discussion.

Nissan’s U.S.-listed shares jumped over 7% on Tuesday, reaching their highest level in nearly a week.

Honda’s shares rose by 1.5%, drawing significant attention from retail investors.

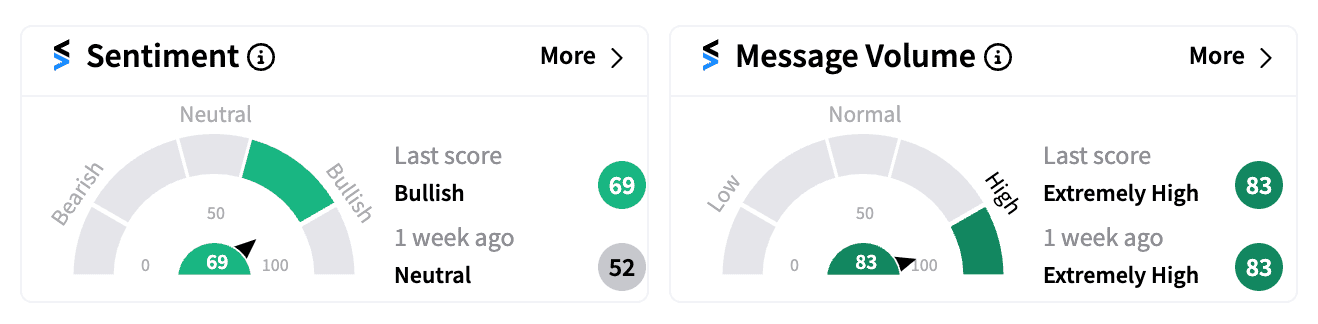

On Stocktwits, Honda saw its message volume spike to ‘extremely high’ levels, marking the second-highest activity for the stock in the past year, with sentiment turning ‘bullish’.

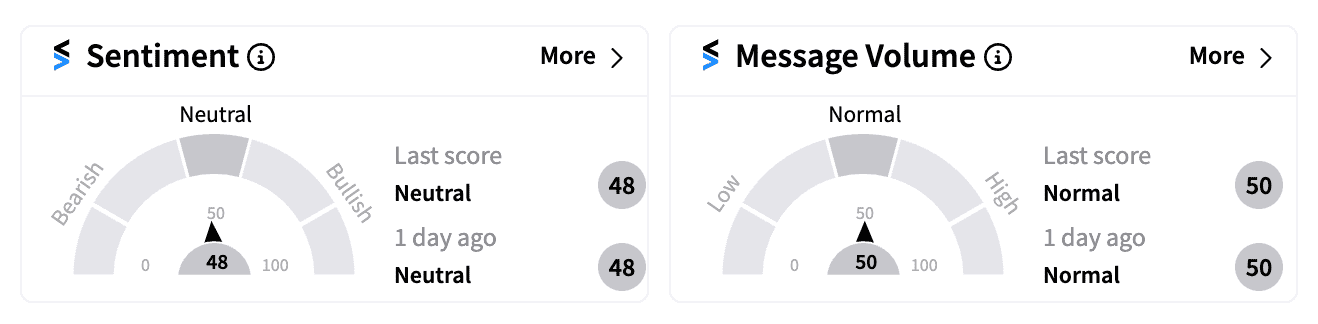

Retail activity for Nissan was a bit more subdued.

Honda and Nissan, Japan’s second and third largest automakers after Toyota, have reportedly been struggling with declining market share in China, where local EV manufacturers have gained dominance.

Despite a combined global sales figure of 7.4 million vehicles in 2023, according to Reuters, both companies face increasing pressure to adapt to the EV-driven transformation of the automobile industry.

Auto mergers are often seen as a potential pathway to accelerate development, reduce costs, and compete more effectively in the global market.

Year-to-date, Honda shares are down 17%, while Nissan has lost 38%.

Investors are now closely watching for further confirmation or denial of the merger talks as the automakers look to solidify their position in a rapidly evolving industry.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2264020227_jpg_4d7420bef3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259210190_jpg_d48bbe3269.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1396534113_jpg_b0e09f299b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Jane_Street_3ac3fb6443.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Truth_social_5bfbc7389b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2221283194_jpg_8178c730a4.webp)