Advertisement|Remove ads.

TCS Q2 Results Beat Estimates — Should You Buy The Dip Or Wait For A Breakout?

Tata Consultancy Services (TCS) shares fell 1% in opening trade on Friday after the IT bellwether posted a solid performance in the September quarter (Q2 FY26), beating market estimates. This was led by improving profitability, a strong order book & AI-led transformation focus.

Q2 profits rose 1.7% year-on-year (YoY) but fell 5% quarter-on-quarter (QoQ) to ₹12,075 crore, with revenues increasing 3.7% (QoQ) to ₹65,799 crore. Margins were steady at 24.76% and India’s largest IT services company declared a second interim dividend of ₹11 per share, with October 15 as the record date, and payable on November 4.

The company reported total contract value (TCV) of $10 billion for the quarter, with multiple large deals across sectors. However, growth in its biggest market, North America, slowed slightly.

TCS CEO K Krithivasan said, “We’re on a journey to become the world’s largest AI-led tech services company.” They are focusing on AI, talent building, and partnerships to drive long-term growth. The company ended the quarter with 6.13 lakh employees and an attrition rate of 13.8%.

How To Trade TCS Stock?

SEBI-registered analyst Mayank Singh Chandel believes that TCS stock is showing signs of recovery. And a breakout above ₹3,203 could mark the beginning of a new uptrend.

He noted that TCS stock has been in a downtrend since September 2024, trading below its 100 & 200-day Exponential Moving Average (EMA), which shows weakness on the higher timeframe. But now it’s finding strong support around ₹3,030 to ₹2,915, a zone where buying interest is visible. The Relative Strength Index stood above 50, suggesting that momentum is improving.

For a safer entry, Chandel advised traders to wait for a breakout above ₹3,203, which could confirm a fresh upside move.

Rerating On The Cards

Front Wave Research believes that TCS has bottomed out and is entering its next curve of growth: from cash preservation to capacity creation.

Over the past decade, TCS has produced cumulative operating cash flows of ₹3.44 lakh crore, with free cash flow at ₹3.17 lakh crore, which translated into an impressive free cash flow conversion rate of approximately 92%.

This performance ranks TCS among the highest globally for large-cap IT companies, they highlighted. It has also been a consistent compounding engine, earning and retaining cash faster than it could deploy.

Front Wave flagged that despite generating more than ₹45,000 crore in annual free cash flow, TCS’s capital reinvestment ratio has historically stayed within the 6–10% range, which showed significant underutilisation of funds. And the time seems ripe to put it into action.

TCS announced its plans for AI dominance and will be building a 1 GW AI data-centre build-out in India, its biggest capacity initiative in over a decade. Front Wave noted that this follows global playbooks similar to those of Google, Meta, and Amazon, which have funnelled surplus capital into data-infrastructure expansion. The analysts believe that this pivot could unlock a new volume-growth driver: moving from people-linked billing to infrastructure-linked scalability.

What Is The Retail Mood?

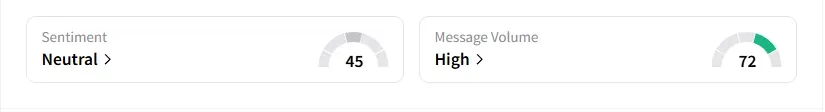

Data on Stocktwits shows that retail sentiment remained ‘neutral’ on this counter amid ‘high’ message volumes.

TCS shares have declined 25% year-to-date (YTD), primarily due to tariff and H1-B visa concerns in the US.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_nintendo_switch_2_jpg_bccd766d3b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2245602336_jpg_dcf0764466.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Core_Weave_jpg_861ba86dd3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_2026_3_jpg_3ea694b5e1.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2240006388_jpg_320990af67.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_trader_stock_chart_resized_861d098b1f.jpg)