Advertisement|Remove ads.

Humana Stock Gains On Upbeat Earnings And Raised Guidance, Draws Retail Praise

Humana Inc. (HUM) raised its full-year earnings outlook on Wednesday after reporting better-than-expected results for the second quarter. The upbeat report led retail traders to compare Humana’s performance with that of UnitedHealth Group (UNH).

Shares of the company traded 8% higher in the premarket session at the time of writing.

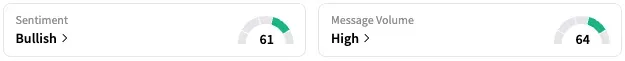

On Stocktwits, retail sentiment around HUM jumped from ‘bearish’ to ‘bullish’ over the past 24 hours, while message volume jumped from ‘normal’ to ‘high’ levels.

According to data from Stocktwits, retail chatter around Humana rose 291% in the past 24 hours.

The health insurer now expects adjusted full-year earnings of approximately $17, up from its previous estimate of about $16.25, and above an analyst estimate of $16.38, according to data from Fiscal AI.

The company also sees higher revenue for the full year of at least $128 billion, compared to its previous guidance range of $126 billion to $128 billion, and above an expected $126.73 billion.

The company also said that it now expects Medicare Advantage membership decline during the year to be lower than previously expected, including the impact of exiting certain unprofitable plans and counties. Humana, a top provider of Medicare Advantage plans, however, reiterated confidence in its pricing strategy.

A Stocktwits user contrasted UnitedHealth Group (UNH) and Humana’s earnings. UNH reinstated guidance on Tuesday after withdrawing it earlier this year. However, the numbers were below Wall Street expectations, dragging down investor sentiment. Its second-quarter earnings also fell below Wall Street expectations.

Yet another Stocktwits user applauded Humana’s update on Wednesday as “great job.”

For the second quarter, Humana reported adjusted earnings of $6.27 per share, above an expected $5.87 per share.

Revenue for the three months through the end of June came in at $32.39 billion, up from $29.38 billion in the corresponding quarter of 2024, and above an analyst estimate of $31.85 billion

Medical cost ratio, representing the percentage of premium spent on medical care, was 89.7% in the period, higher than the 89% in the second quarter of 2024. This is, however, in line with the company's previously disclosed expectation of 'approximately 90 percent,' it noted

“We feel good about our solid performance in the first half of the year,” said CEO Jim Rechtin.

HUM stock is down by 8% this year and by over 42% over the past 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_lucid_gravity_jpg_173d7fb4ec.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2250240969_jpg_dd9be8c5ea.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trump_jpg_4a30f2c834.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_donald_trump_tariffs_chart_jpg_9309f5e523.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2242061511_jpg_742d610600.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2164981884_1_jpg_100f5d0da3.webp)