Advertisement|Remove ads.

Bitcoin Miners Hut 8, Marathon Outshine Coinbase As Retail Favorites Among Rosenblatt’s Crypto-Linked Stock Picks

Rosenblatt Securities initiated coverage on several crypto-linked stocks with a bullish outlook on Friday, citing long-term tailwinds from institutional adoption and regulatory clarity.

While the firm’s recommendations covered multiple names, retail traders are overwhelmingly bullish on just two: Hut 8 (HUT) and Marathon Holdings (MARA).

Hut 8’s stock edged upward in pre-market trade on Friday after Rosenblatt gave the stock a ‘Buy’ rating with a price target of $23, implying an upside of 70% from Thursday’s closing, according to TheFly.

The brokerage cited the company’s merger with U.S. Bitcoin Corp as a key value driver despite initial restructuring costs weighing on early results.

With multiple revenue streams expected to ramp up in Q1 and high-margin high-performance computing (HPC) operations set to come online before the end of 2025, Rosenblatt argues that Hut 8 remains undervalued despite its recent outperformance.

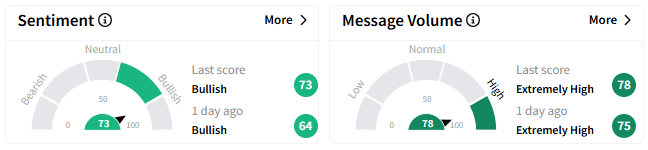

Investors appear to agree. Retail sentiment around Hut 8’s stock ticked higher in the ‘bullish’ zone, accompanied by ‘extremely high’ levels of chatter.

The company’s shares, however, remain down more than 36% year-to-date.

Meanwhile, Mara Holdings’s stock dipped by more than 1.5% in pre-market trade on Friday, even after Rosenblatt initiated coverage with a ‘Buy’ rating and a $19 price target, implying an upside of 26% from Thursday’s closing.

Rosenblatt called MARA the “dominant” player among public Bitcoin miners, noting its industry-leading scale and its now majority-owned 1.5 GW power portfolio across 16 global sites.

The brokerage also sees MARA as one of the most leveraged plays on Bitcoin’s upside, despite concerns over interest rates and dilution from aggressive share issuance.

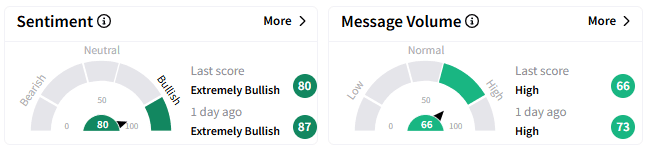

Unlike other names in the report, MARA was the only stock to show ‘extremely bullish’ sentiment on Stocktwits, with ‘high’ levels of trader chatter.

Meanwhile, shares of the largest name by market capitalization on Rosenblatt's list, Coinbase (COIN) rose nearly 1% in pre-market trade after Rosenblatt initiated coverage with a ‘Buy’ rating and a $305 price target – implying a more than 40% upside.

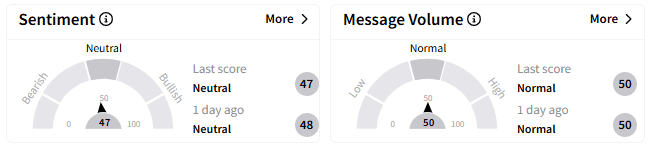

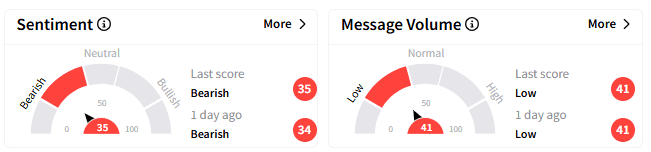

However, retail sentiment around the crypto exchange remained tepid.

The brokerage sees the new U.S. administration as a major tailwind for crypto, predicting that clearer regulations and the recently announced Bitcoin Strategic Reserve will drive institutional adoption.

However, Rosenblatt warns that recent volatility in the crypto sector remains a risk and argues that Coinbase, as the “clear blue chip” in the industry, offers a safer way to gain exposure.

Retail sentiment on Stocktwits around Coinbase’s stock remained ‘neutral. ’ The stock has declined over 16% year-to-date.

Cipher Mining (CIFR) shares also gained in pre-market trade on Friday after Rosenblatt issued a ‘Buy’ rating with a $6.50 price target, implying a 70% upside.

The brokerage values Cipher at six times the expected forward adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA), slightly above its peer average of 5.7 times.

Rosenblatt argues that the premium is warranted by the company’s anticipated entry into the higher-margin HPC business.

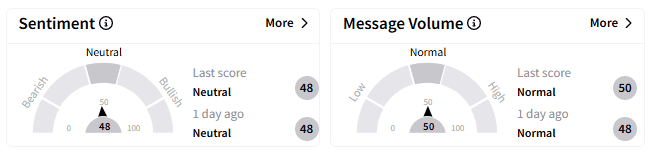

Despite the upbeat coverage, retail traders remain unconvinced. On Stocktwits, retail sentiment remained in ‘neutral’ territory, and the stock is down more than 20% this year.

Meanwhile, Hive’s stock traded lower in pre-market trading, dropping as much as 1% despite receiving a ‘Buy’ rating and a $6 price target.

Rosenblatt sees Hive as one of the most compelling growth stories in Bitcoin mining, highlighting its planned fourfold increase in hash rate via three new hydro-powered data centers in Paraguay.

The firm also projects Hive’s HPC business will expand from $10 million in annual recurring revenue to $100 million once new hardware comes online.

Despite the tailwinds highlighted by Rosenblatt, retail sentiment on Stocktwits around the Bitcoin miner’s stock remained in the ‘bearish’ zone.

The stock is down over 36% so far this year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Gold_bars_02f67954d1.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2258839311_jpg_35f0914ce1.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2198547045_jpg_e6c30993de.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2240656304_jpg_754321c130.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_pharma_stock_jpg_490939e580.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_down_resized_901c19c371.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)