Advertisement|Remove ads.

Hyatt Hotels Stock Slips On Price Target Revisions After Q4 Earnings Miss: Retail Stays Cautious

Shares of Hyatt Hotels Corp. ($H) fell more than 3% on Friday after several analysts revised their price targets following the hotel chain’s fourth-quarter earnings miss, with retail sentiment turning cautious.

Bernstein lowered its price target for Hyatt to $173 from $188, maintaining an ‘Outperform’ rating. The research firm noted that Hyatt’s 9% drop in share price post-earnings was hard to justify purely on fundamentals. The company’s miss on earnings before interest, taxes, and depreciation, along with below-consensus full-year earnings, could be attributed to a “bigger disposal impact than modeled.” Bernstein added that Hyatt may see price target increases and RevPAR growth in the coming year.

Barclays analyst Brandt Montour lowered the price target to $151 from $162 with an ‘Equal Weight’ rating. According to the analyst, Hyatt’s lower core net rooms growth outlook weighs on the bull thesis, just as the company is looking to add to its sizable owned asset portfolio, Fly reported, citing the analyst.

Meanwhile, Deutsche Bank analyst Carlo Santarelli raised the firm's price target to $145 from $127 with a ‘Hold’ rating.

Hyatt’s earnings per share came in at $0.42, missing estimates of $0.76. Its revenues came in line with expectations at $1.6 billion.

For 2025, Hyatt said it expects system-wide hotels RevPAR growth of 2.0% to 4.0%. The company didn’t provide guidance on EPS because of pending acquisition of Playa Hotels & Resorts

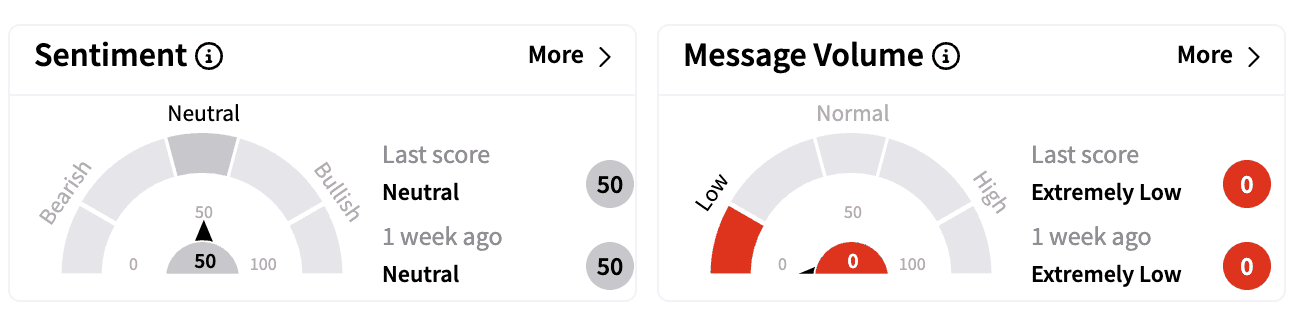

Sentiment on Stocktwits remained ‘neutral’ compared to a week ago. Message volume was in the ‘extremely low’ zone.

Last week, Hyatt said it plans to buy hotel chain Playa Hotels for $2.6 billion, for $13.50 per share, including about $900 million of debt, net of cash, according to a company statement.

Last week, Hyatt said it plans to buy hotel chain Playa Hotels for $2.6 billion, for $13.50 per share, including about $900 million of debt, net of cash, according to a company statement.

Hyatt stock is down 9% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2243050664_jpg_37b52748e2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_rising_resized_f17852d7aa.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_natural_gas_plant_resized_jpg_e43db2dc7b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_JP_Morgan_JPM_resized_jpg_5def7e91d0.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)