Advertisement|Remove ads.

ICICI Bank Shares Drop Profit Growth In Q2; Analyst Flags Cash Flow Concerns

- ICICI Bank posted a 5.2% YoY rise in net profit to ₹12,359 crore

- Q2 results showed signs of strain in core operations

- Rising expenses and a sharp reversal in operating cash flow worry analysts.

Shares of ICICI Bank, India’s second-largest private sector lender, fell as much as 2.7% to ₹1,397.8 on Monday, despite posting a profit growth for the second quarter.

Net Profit Rises While NPAs Fall

ICICI Bank posted a 5.2% year-on-year (YoY) rise in net profit to ₹12,359 crore for Q2FY26, compared with ₹11,746 crore a year earlier. Net interest income (NII) grew 7.4% to ₹21,529 crore, supported by healthy loan growth and stable funding costs, while the net interest margin stood firm at 4.30%.

Provisions (excluding tax) declined to ₹914 crore from ₹1,233 crore a year ago, indicating stronger asset quality and improved recoveries. The bank’s gross non-performing asset (NPA) ratio improved to 1.58% from 1.67% sequentially, while net NPA eased to 0.39% from 0.41%.

Operating Cash Flow Issues

ICICI Bank reported a mixed Q2 FY26 performance, with asset quality improvements supporting a 25.87% decline in provisions and standalone PAT rising 5.22%. Provisioning coverage remained healthy at 75%, supported by a contingency buffer of ₹13,100 crore.

However, core operating performance showed signs of stress, noted SEBI-registered Front Wave Research.

Net interest income growth moderated to 7.42%, operating expenses surged 12.43%, exceeding guidance, and loan and deposit growth decelerated, with deposits nearly flat sequentially. Consolidated Pre-Provision Operating Profit (PPOP) edged up just 0.48%.

A key red flag is the sharp reversal in operating cash flow, with H1 FY26 seeing an outflow of ₹19,167 crore compared to an inflow of ₹51,952 crore in H1 FY25, they said.

While asset quality remains strong, moderation in core income growth, rising costs, and cash flow weakness suggest caution for near-term performance.

Retail Remains Bullish

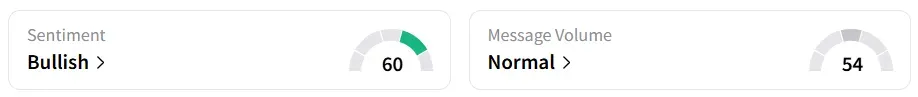

Despite the intra-day decline, retail sentiment for the stock remains ‘bullish’. It was ‘bearish’ a week back.

The stock is the biggest laggard on the Nifty 50 and is on track to record its first loss in six sessions.

Year-to-date, the stock has gained around 10%.

For updates and corrections, email newsroom[at]stocktwits[dot]com

/filters:format(webp)https://news.stocktwits-cdn.com/large_Tether_2376a55503.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_robert_kiyosaki_d28a01cb4b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_and_Ethereum_2b4356b70a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_976546456_jpg_42ddd4a81d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259655311_jpg_20124bbeb9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Donald_Trump_451371e34e.webp)