Advertisement|Remove ads.

ImmunityBio Stock Breaks Out Of Long Slump, Tests $3 Zone: Ex-UBS Analyst Flags ‘Huge’ Bullish Signals

ImmunityBio logged its fourth straight day of gains on Tuesday, climbing to its highest level in nearly a month as shares broke above the 200-day moving average amid optimism from Anktiva trial data showing survival benefits in lung cancer patients.

Technical Setup

ImmunityBio Investor and former UBS analyst David Din said in a post on X that the stock has finally broken out of a long slump dating back to April 2024, now showing a pattern of “higher highs and higher lows.”

He pointed to several bullish indicators: a moving average convergence divergence (MACD) crossover (a signal that momentum is shifting upward) and a divergence in relative strength index (showing buying strength building even while the stock had been falling).

He also pointed to a positive signal from the Ichimoku Cloud indicator, which provides both forward- and backward-looking views of market trends. For IBRX, the short-term conversion line (blue) has crossed above the longer-term baseline (red), a move that could signal a bullish shift in momentum.

Din described the move above the 200-day moving average as “huge,” noting the stock had tested this level before but pulled back, and could now make another attempt to push higher.

He marked $3.04 as the next Fibonacci level, comparing the setup to past surges he called “God Candles,” where the stock jumped 20%–27% in a single day and cleared multiple technical barriers.

He added that Bollinger Bands, which measure volatility, are starting to widen, similar to October 2024 when a sudden spike helped define the stock’s long-term downtrend. With that trendline now broken, Din said there is no major technical ceiling left to stop another strong move.

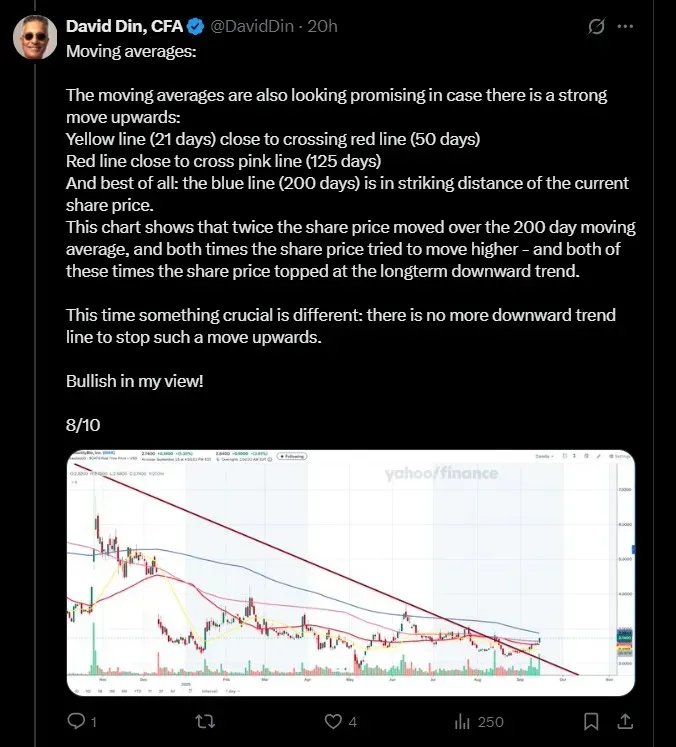

Din also flagged a gap on the chart at $4.50, predicting it would be filled, and noted that shorter-term moving averages are lining up in a bullish fashion: the 21-day average is nearing a crossover of the 50-day, the 50-day is close to crossing the 125-day, and the 200-day is now within reach.

Lung Cancer Study

The stock’s momentum comes alongside clinical data presented at the IASLC 2025 World Conference on Lung Cancer.

ImmunityBio reported that its experimental drug, Anktiva, reversed lymphopenia in patients with checkpoint inhibitor-resistant advanced non-small cell lung cancer. Patients showed absolute lymphocyte counts above 1,500 cells/μL, achieving a median overall survival of 21.1 months.

On Stocktwits, retail sentiment for ImmunityBio was ‘bullish’ amid ‘high’ message volume, with traders upbeat on strong charts, rising volumes, and fresh buying interest.

On Stocktwits, one user noted that ImmunityBio shares were trading around $2.90, describing it as a key resistance level, and said the move higher came with strong momentum, as both price and volume continued to exceed recent averages.

Another user mentioned they had accumulated several thousand shares in anticipation of a breakout. A third said the three-month chart looked “extremely bullish,” while a fourth remarked that they liked the setup and had taken a large position in the stock.

ImmunityBio’s stock has risen 9.8% so far in 2025.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2195880631_jpg_5d50833996.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227553102_jpg_9cb79c1b5b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2236688965_jpg_b00d009983.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2231423801_jpg_f64bcdbb33.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2242062032_jpg_b5e44cfa75.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Trade_desk_logo_resized_c0229eb2ab.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)