Advertisement|Remove ads.

India Cements Chart Signals Strength Ahead Of Q1 Earnings: SEBI RA Deepak Pal

India Cements gears up to report its first-quarter (Q1FY26) earnings later this week on July 19.

SEBI-registered analyst Deepak Pal noted that on its weekly chart, the stock is showing a bullish structure with India Cements consistently holding above its 14-day Exponential Moving Average (EMA) and 50-day moving average, indicating strong technical support.

For the past three weeks, the stock has displayed solid upward momentum and continues to trade above its breakout level, reflecting sustained strength on both daily and weekly charts.

With results around the corner, Pal believes some volatility may be expected in the short term. However, the overall trend remains positive, and India Cements appears favorable for a buy-on-dip strategy from a long-term investment perspective.

Pal suggested that if the momentum sustains, the stock has the potential to move toward the ₹360–₹370 range in the coming weeks.

Fundamentally, its recent financial performance has been under pressure due to rising input costs, weak cement demand in key markets, and high debt levels.

As of FY24, revenue stood at ₹5,644 crore with a net loss of ₹181 crore, and EBITDA margins remained weak at around 6%. The debt-to-equity ratio is high at 1.3x, indicating financial stress.

Pal highlighted that while the company held significant market presence in the southern region, its profitability, cash flows, and return ratios have remained subdued. Going forward, a revival in infra demand and capacity rationalization will be key to India Cements' recovery, but the near-term outlook remains cautious.

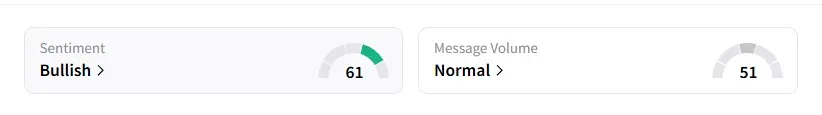

Data on Stocktwits shows that retail sentiment is ‘bullish’ on this counter.

India Cements shares have fallen 7% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2238737789_jpg_eca1ed4bd9.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259293616_jpg_38a91a25a8.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_American_Express_resized_d6044f410d.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_axsome_resized_jpg_09f7c99fb1.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1238223992_jpg_be616a7919.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_ibm_signage_mwc_resized_28f91e1a63.jpg)