Advertisement|Remove ads.

India’s banking story back on global radar as foreign deals pick up

Nomura India’s Amit Thawani sees a favourable risk-reward and strong growth outlook, supported by capital inflows from Asia and the Middle East, while former SBI Chairman Rajnish Kumar calls it a positive trend but cautions that rising competition will aid consumers and push smaller banks to improve efficiency.

A recent flurry of high-profile deals has signalled a strong resurgence of foreign investor interest in the Indian banking sector, a trend that experts attribute to India's robust economic outlook and a supportive regulatory environment. According to Amit Thawani, Managing Director and Head of Investment Banking at Nomura India, and Rajnish Kumar, former Chairman of the State Bank of India (SBI), this influx of capital is a significant vote of confidence in the country's financial landscape.

Transactions such as Blackstone's stake acquisition in Federal Bank, the RBL Bank-Emirates NBD deal, and private equity interest in Yes Bank and IDFC First Bank have highlighted this trend. Thawani stated that the first half of the fiscal year has seen a flurry of activity from both private and strategic capital providers.

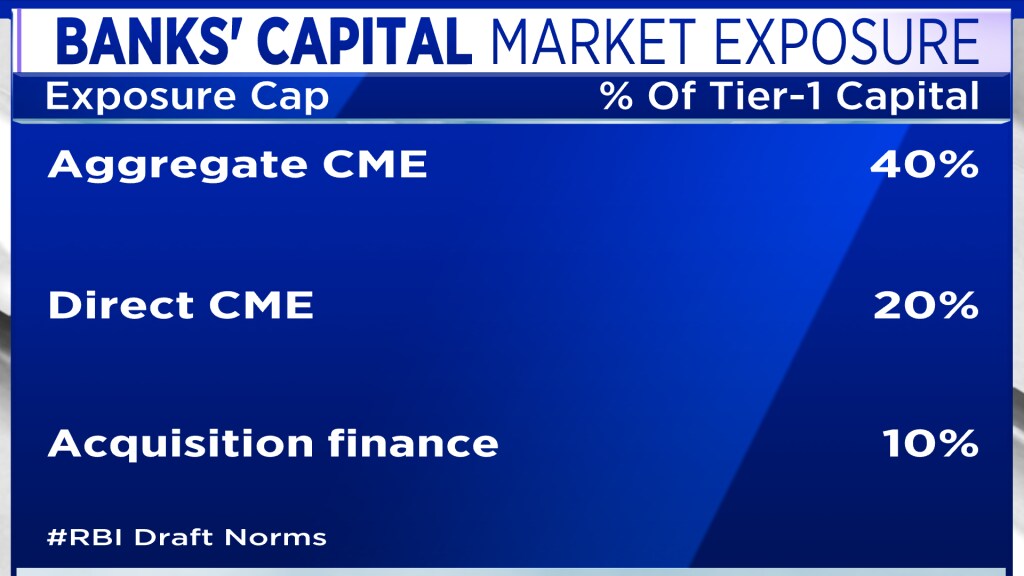

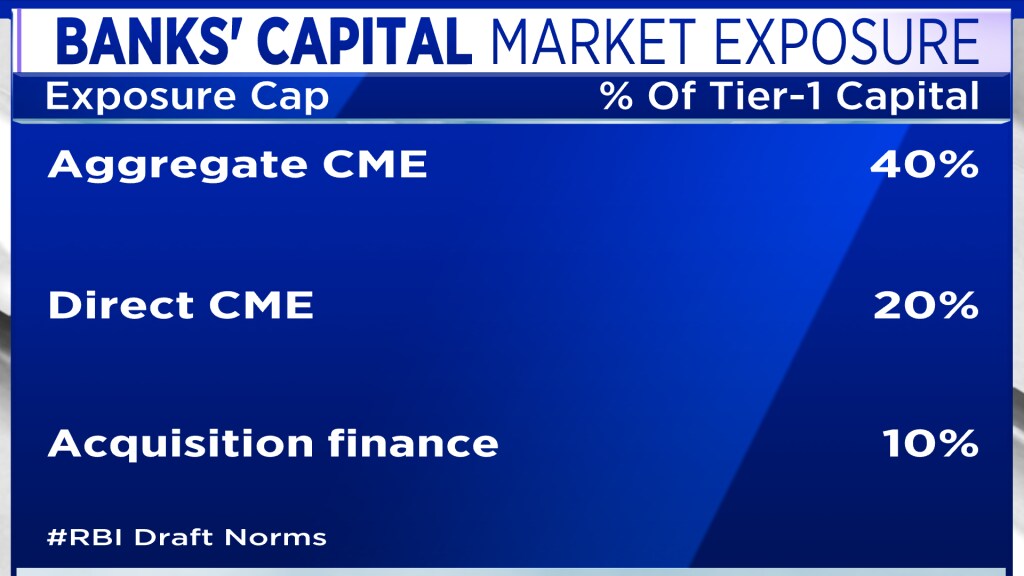

He identified three core reasons for this renewed interest: an economy where growth is kicking off, a proactive Reserve Bank of India (RBI) that has introduced norms to aid credit creation, and an Indian banking sector that is well-poised in terms of technology and balance sheet strength to capture this growth. "The core of the matter is that you have a very strong economy, you have a very strong banking and financial sector, and that's raring to grow," Thawani said. While each deal has its own specific rationale, he suggested that the risk-reward for investors currently looks favourable.

Thawani also highlighted active investment corridors, noting that the "Asia corridor," including Japanese and Korean players, has been and will remain active, citing past deals like SMFG buying Fullerton. He also pointed to the "Middle East corridor" as a "great trend to watch out into," given the commonalities in business and culture.

Also Read | RBI’s M&A lending push won’t shake up private credit just yet, says GreenEdges' Digant Haria

Rajnish Kumar offered a more balanced perspective. While agreeing that foreign interest is a positive reflection on the Indian economy, he cautioned against getting "very gung-ho." He pointed out that the market share of foreign banks has declined since the 1990s, with some, like Citibank, exiting the domestic market. According to Kumar, these investments are often a strategic move to gain a foothold, with the wealth and personal banking segments being the most attractive due to India's growing middle class and high-net-worth individual population.

Kumar also emphasised that increased competition from foreign-backed players will ultimately benefit consumers through improved services. However, he stressed that the competitive landscape is not a "level playing field." Public sector banks, private banks, and foreign-owned banks operate with different mandates. "In case of government ownership, that is not as prominent because the public sector banks they are to do certain businesses where it's not always driven by the commercial interest or the profit," he explained. He believes foreign banks will mostly focus on wholesale banking and wealth management rather than mass-market retail, which is a "tough task."

This influx of capital is expected to intensify competition, particularly for tier-two and tier-three banks, which will need to efficiently manage their capital and refine their business strategies to attract investors. As Kumar stated, capital is available, but only for institutions that can generate returns commensurate with investor expectations.

Also Read | Banks lead renewed investor interest in Indian financials

For the entire discussion, watch the accompanying video

Catch all the latest updates from the stock market here

Transactions such as Blackstone's stake acquisition in Federal Bank, the RBL Bank-Emirates NBD deal, and private equity interest in Yes Bank and IDFC First Bank have highlighted this trend. Thawani stated that the first half of the fiscal year has seen a flurry of activity from both private and strategic capital providers.

He identified three core reasons for this renewed interest: an economy where growth is kicking off, a proactive Reserve Bank of India (RBI) that has introduced norms to aid credit creation, and an Indian banking sector that is well-poised in terms of technology and balance sheet strength to capture this growth. "The core of the matter is that you have a very strong economy, you have a very strong banking and financial sector, and that's raring to grow," Thawani said. While each deal has its own specific rationale, he suggested that the risk-reward for investors currently looks favourable.

Thawani also highlighted active investment corridors, noting that the "Asia corridor," including Japanese and Korean players, has been and will remain active, citing past deals like SMFG buying Fullerton. He also pointed to the "Middle East corridor" as a "great trend to watch out into," given the commonalities in business and culture.

Also Read | RBI’s M&A lending push won’t shake up private credit just yet, says GreenEdges' Digant Haria

Rajnish Kumar offered a more balanced perspective. While agreeing that foreign interest is a positive reflection on the Indian economy, he cautioned against getting "very gung-ho." He pointed out that the market share of foreign banks has declined since the 1990s, with some, like Citibank, exiting the domestic market. According to Kumar, these investments are often a strategic move to gain a foothold, with the wealth and personal banking segments being the most attractive due to India's growing middle class and high-net-worth individual population.

Kumar also emphasised that increased competition from foreign-backed players will ultimately benefit consumers through improved services. However, he stressed that the competitive landscape is not a "level playing field." Public sector banks, private banks, and foreign-owned banks operate with different mandates. "In case of government ownership, that is not as prominent because the public sector banks they are to do certain businesses where it's not always driven by the commercial interest or the profit," he explained. He believes foreign banks will mostly focus on wholesale banking and wealth management rather than mass-market retail, which is a "tough task."

This influx of capital is expected to intensify competition, particularly for tier-two and tier-three banks, which will need to efficiently manage their capital and refine their business strategies to attract investors. As Kumar stated, capital is available, but only for institutions that can generate returns commensurate with investor expectations.

Also Read | Banks lead renewed investor interest in Indian financials

For the entire discussion, watch the accompanying video

Catch all the latest updates from the stock market here

Read about our editorial guidelines and ethics policy

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2214520036_jpg_38627c2e7e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_wall_street_resized1_jpg_7f200ce842.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_chart_rising_resized_6ebc3dd7e4.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_uptrending_stock_resized_e22f46d710.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/shanthi_v2_compressed_98c13b83cf.png)

/filters:format(webp)https://images.cnbctv18.com/uploads/2025/10/20241109033650_sensex_nifty_stock_markets.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/cnbctv18logo.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_huntington_OG_jpg_0f4cdc1ca5.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)