Advertisement|Remove ads.

Infinera Misses Q4 Profit Estimates, But Nokia’s $2.3B Buyout Approval By EU Lifts Stock After-Hours: Retail Sentiment Split

Shares of Infinera Corp. (INFN) edged up in after-hours trade on Thursday after the company announced its acquisition by Nokia Corp. (NOK) is expected to close on or before Friday. The company also posted its fourth-quarter earnings, which missed Wall Street estimates.

Infinera reported earnings per share (EPS) of $0.03 in Q4, missing expectations of $0.11. During the same period last year, it posted an EPS of $0.12.

The optical networking solutions provider reported revenue of $414.4 million during the quarter, ahead of an estimated $409.1 million. However, it fell 8.6% year-on-year (YoY) from $453.5 million a year earlier.

Infinera’s revenue in 2024 was $1.1 billion, down from $1.3 billion a year ago. It reported a loss per share of $0.19 in 2024, compared to an EPS of $0.23 in 2023.

Despite the mixed Q4 results, Infinera’s stock gained in extended trading as the company announced that it expects its merger with Nokia’s wholly-owned subsidiary, Neptune of America Corp., to be completed on or before Friday.

In the meantime, the European Union Commission unconditionally approved the $2.3 billion deal. This makes Nokia the second-largest optical networking vendor with a 20% market share, behind China’s Huawei.

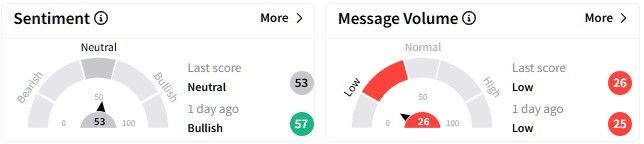

On Stocktwits, retail sentiment around the Infinera stock was in the ‘neutral’ (53/100) territory, edging lower from ‘bullish’ a day ago.

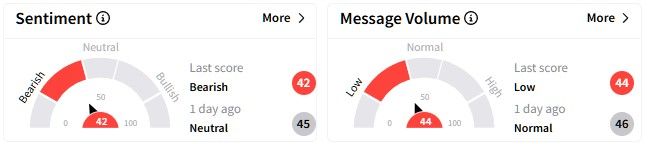

On the other hand, retail investors were less optimistic about Nokia, with sentiment entering the ‘bearish’ (42/100) territory from ‘neutral’ a day ago.

One user pointed out that no one is talking about Nokia’s connectivity solutions reaching the moon.

Infinera’s stock has gained nearly 30% over the past year, while Nokia’s stock performed slightly better, with gains of nearly 36%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Also See: ARBB Stock Soars After-Hours On AI Data Center Deal In Malaysia: Retail Buzz Explodes

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2230137825_jpg_d14459f501.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2217651250_jpg_908ef236f4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2194622714_jpg_c18475d557.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2199618807_jpg_0e9f26c6c5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262651778_jpg_54075aa1d9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2246580703_jpg_9700e1e7e8.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)