Advertisement|Remove ads.

Informatica Stock Plunges To Nearly 2-Year Low On Disappointing Q4 Revenue, Downbeat Guidance: Retail Sees Buying Opportunity

Shares of Informatica, Inc. (INFA), an artificial intelligence (AI)- powered enterprise cloud data management platform provider, slumped in premarket trading on Friday after the company's big fiscal year 2024 fourth-quarter revenue miss and subpar guidance.

The Redwood City, California-based company reported fourth-quarter adjusted earnings per share (EPS) of $0.41, up from $0.32 earned a year ago and exceeding the $0.37 consensus estimate.

Quarterly revenue fell 3.8% year over year (YoY) to $428.3 million, missing the $456.71 million consensus estimate and the $448 million to $468 million guidance. The company noted if not for a positive currency impact, the top line would have declined by 4.1%.

The company attributed the subpar revenue performance to three factors which include:

- Lower upfront self-managed subscription license revenue due to lower renewal rates

- Lower average duration of these self-managed subscription renewals further reducing up-front recognized revenue

- Strategy to shift more of customers’ implementation and support work to its professional service partners

- Forex-related revenue headwinds compared to its forecast

Informatica said its subscription revenue fell 2% YoY to $297.4 million despite cloud subscription revenue rising 33%. Subscription annual recurring revenue (ARR) climbed 17% to $1.27 billion, versus the guided range of $1.265 billion to $1.299 billion.

The company’s adjusted operating income was $162.3 million, compared to the guidance of $162 million to 182 million. The non-GAAP operating margin rose 150 basis points to 37.9%.

Informatica CEO Amit Walia said, “Although we encountered unexpected headwinds in the fourth quarter, we're entering 2025 with strong fundamentals and clear line of sight to reaching $1 billion in Cloud Subscription ARR by the end of the year."

Looking ahead, the company expects revenue of $380 million to $400 million, for the first quarter and $1.670 billion to $1.720 billion for fiscal year 2025.

Analysts, on average, expect $408.83 million and $1.74 billion, respectively.

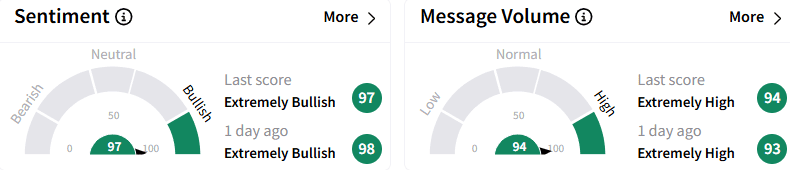

On Stocktwits, retail sentiment toward Informatica stock remained ‘extremely bullish’ (97/100), with the message volume at an ‘extremely high’ level.

A retail watcher said the stock is way oversold.

In premarket trading, Informatica stock plunged 35.40% to $16.26, the lowest level since late May 2023. If the premarket losses carry over to the regular session, the stock is on track to experience the biggest one-day loss in three years.

The stock has lost about 3% so far this year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2254648547_jpg_a843db78b6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1000648682_jpg_6aa61e3574.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259602028_jpg_5b1a490e64.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259775985_jpg_a06a1e88c3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_dogecoin_OG_2_jpg_304df31f25.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_vitalik_buterin_OG_jpg_7ac8ea93fe.webp)