Advertisement|Remove ads.

Infosys Under Pressure Despite Solid Q2 Earnings; Technical Indicators Signal Caution

Shares of IT bellwether Infosys fell 1.8% to ₹1,444.70 in early trade on Friday, despite reporting a decent Q2 print. This marks Infosys’ fifth straight session of declines.

The Nifty IT index was down 1.5%, the biggest sectoral laggard, with Wipro’s 4.4% fall being the top percentage decline.

Net Profit Rises 13%

Infosys reported a consolidated net profit of ₹7,364 crore in Q2FY26, marking a 13.2% year-on-year (YoY) rise, supported by steady growth in large deal wins. Revenue climbed 8.6% YoY to ₹44,490 crore, while operating margin stood at 21%.

In constant currency terms, revenue grew 2.9% YoY. The company also declared an interim dividend of ₹23 per share.

Infosys expects FY26 revenue growth of 2% - 3% in constant currency with an operating margin range of 20% – 22%.

Developing Bearish Setup

Infosys’ stock continues to show weakness despite stable Q2 numbers, with charts indicating a developing bearish setup, said SEBI-registered analyst Rajneesh Sharma.

The stock trades near ₹1,470, down almost 3% for the week, having slipped below its long-term support trendline.

The 30-week moving average around ₹1,515 - ₹1,550 now acts as resistance, while a descending triangle pattern within the ₹1,350 - ₹1,950 range signals further caution, according to Sharma.

Relative Strength remains weak versus the Nifty, and rising sell volumes reinforce the bearish bias. A close above ₹1,515 could revive momentum; until then, sentiment stays negative. Support lies at ₹1,350 - ₹1,375, he added.

Despite operational discipline and strong deal flow, muted revenue visibility and technical breakdowns suggest limited near-term upside, according to Sharma.

₹1,555 Could Signal Momentum Reversal

Technically, Infosys stock is hovering above a key support zone of ₹1,420 - ₹1,350, a region that has previously triggered short-term bounces, said SEBI-registered analyst Mayank Singh Chandel.

However, the stock remains below its 21-day, 50-day, and 200-day exponential moving averages (EMA), indicating a weak broader trend. A sustained close above ₹1,555 could signal a potential reversal, he added.

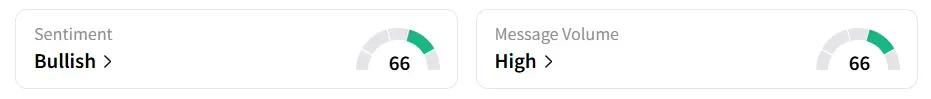

Retail Bullish

Despite the shares falling, retail sentiment flipped to ‘bullish’ amid ‘high’ market chatter on Stocktwits. It was ‘bearish’ a session earlier.

However, the stock has been under heavy selling pressure this year, declining more than 23%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2209881066_jpg_ebc4b9b217.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_us_japan_jpg_5a4a8c1f81.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227931078_jpg_7ccfff654b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2221559761_jpg_71120b5aaa.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Robotaxi_Tesla_jpg_209f017098.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_AT_and_T_store_resized_542005da9b.jpg)