Advertisement|Remove ads.

INOD Stock On Track To Break A Six-Day Losing Streak: Here’s Why

- Innodata announced the formation of a new unit called Innodata Federal.

- For Q3, the company’s revenue and EPS came in above street estimates.

- The stock saw a 203% surge in user message count in 24 hours on Stocktwits.

Innodata Inc. (INOD) stock sparked retail investors' interest as the stock looks to break a six-day losing streak on Q3 earnings and the launch of its federal business unit.

In the third quarter (Q3), the company reported a revenue of $62.6 million, a 20% increase year-on-year, and an earnings per share (EPS) of $0.26. Both revenue and EPS surpassed the analyst consensus estimate of $59.78 million and $0.14, respectively, according to Fiscal AI data.

Innodata Federal

On Thursday evening, the company also announced the formation of a new unit called Innodata Federal, crafted specifically to serve U.S. defense, intelligence and civilian agencies with mission-critical artificial-intelligence solutions.

To facilitate business with the government, Innodata said retired four-star Army General Richard D. Clarke, former commander of the U.S. Special Operations Command, has joined its board.

Innodata Federal follows a dual-track approach, securing revenue now via prime-contractor work while cultivating direct government relationships for larger contracts later. That mix aims to deliver both immediate income and steady, long-term expansion.

The unit presents a full suite of capabilities: data-engineering and model-training services, generative AI, agentic AI, and automation.

What Are Stocktwits Users Saying?

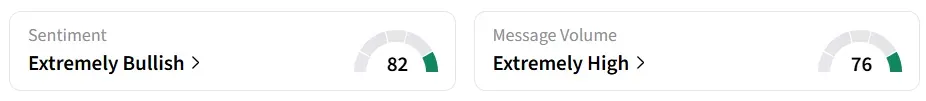

Innodata stock traded over 10% higher in Friday’s premarket and was among the top two trending equity tickers on Stocktwits. Retail sentiment around the stock jumped to ‘extremely bullish’ from ‘bearish’ territory the previous day. Message volume improved to ‘extremely high’ from ‘normal’ levels in 24 hours.

The stock saw a 203% surge in user message count in 24 hours.

A Stocktwits user said, ‘they are moving away from their reliance on their biggest client to drive revenue and instead diversifying revenue streams.’

Another bullish user highlighted the fact that the company is still in a recruitment drive when other big tech names are laying off employees.

Innodata stock has gained over 54% in 2025 and over 150% in the last 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263898051_jpg_9e75888009.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2241292402_jpg_9661b0c852.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_rising_resized_f17852d7aa.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_adam_smigielski_K5m_Pt_O_Nmp_HM_unsplash_f365ee93f4.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2058827032_jpg_5505a2a083.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_526218674_jpg_7b7468812b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)