Advertisement|Remove ads.

Intel Stock Eyes Best Winning Streak In Over A Year As Retail Stays ‘Bullish’ On Hopes Of A Turnaround

Shares of Intel Corp. (INTC) traded slightly down on Friday after climbing as much as 0.8%.

If the stock manages to close higher today, it will mark seven consecutive sessions of gains, the longest winning streak since Sept. 7, 2023, when it posted nine straight days of increases.

Intel, surprisingly, is the best performer on the Dow Jones Industrial Average (DIA) this month — the same index from which investors worried it would be removed recently.

Intel is navigating one of the toughest periods in its 56-year history, grappling with the consequences of falling behind competitors like Nvidia and AMD in both manufacturing and the AI race.

The company is on track for its third straight year of declining revenue.

Despite these challenges, some recent developments have sparked renewed investor optimism.

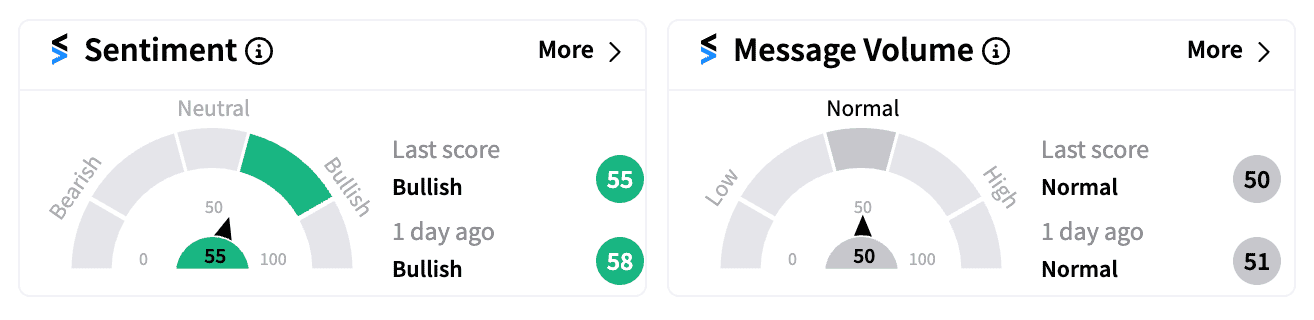

On Stocktwits, retail sentiment for INTC was ‘bullish’ (55/100) on Friday afternoon amid normal message volume, reflecting growing confidence in a potential turnaround for the chip giant.

Intel has implemented a series of aggressive cost-cutting measures, including a 15% workforce reduction and suspension of its dividend.

The company also plans to reduce or exit two-thirds of its global real estate portfolio by year-end and has started selling part of its stake in Altera, its programmable chip business.

CEO Pat Gelsinger has announced Intel Foundry will become an independent subsidiary, a move aimed at sharpening focus on the company’s manufacturing capabilities.

Bloomberg reported on Friday, citing sources, that Intel rejected an approach from Arm Holdings (ARM) to purchase its product division that manufactures chips for personal computers, servers, and networking equipment.

Meanwhile, there have been discussions of major investments. Apollo Global Management (APO) reportedly offered a $5 billion equity-like investment into Intel.

Earlier in the month, reports circulated that Qualcomm (QCOM) had approached Intel regarding a potential acquisition.

However, analysts at Benchmark suggested such a deal is unlikely, citing a hefty price tag and significant regulatory hurdles.

Despite its recent uptrend, Intel stock is still down more than 50% this year.

Read next: Apple Gets 2 Upbeat Analyst Notes: Stock Climbs But Retail Still Bearish Amid iPhone 16 Worries

/filters:format(webp)https://news.stocktwits-cdn.com/large_eric_trump_OG_jpg_19bc149869.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Palantir_jpg_da95861470.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trade_Desk_jpg_e7ed8e2266.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2243565350_jpg_6cd80dbe6d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_capricor_jpg_9f4f8ab098.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233716109_jpg_230d917a7e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)