Advertisement|Remove ads.

Intel Stock Rises Pre-market On Apollo Global Offer Report: Retail Sentiment Soars

Shares of Intel Corp (INTC) rose over 4% in Monday’s pre-market session as of 7:42 a.m. ET after Bloomberg News reported over the weekend that alternative asset manager Apollo Global Management (APO) has offered to make an equity-like investment of about $5 billion into the chip-maker.

Bloomberg reported that the size of the deal may change or the discussions may even fail. Intel is reportedly weighing options as of now.

The development comes at a time when Qualcomm Inc (QCOM) has already approached Intel for a potential acquisition, according to The Wall Street Journal. Qualcomm’s deal is far from certain according to the news outlet, which added that even if the deal goes through, the firm could sell assets or parts of Intel.

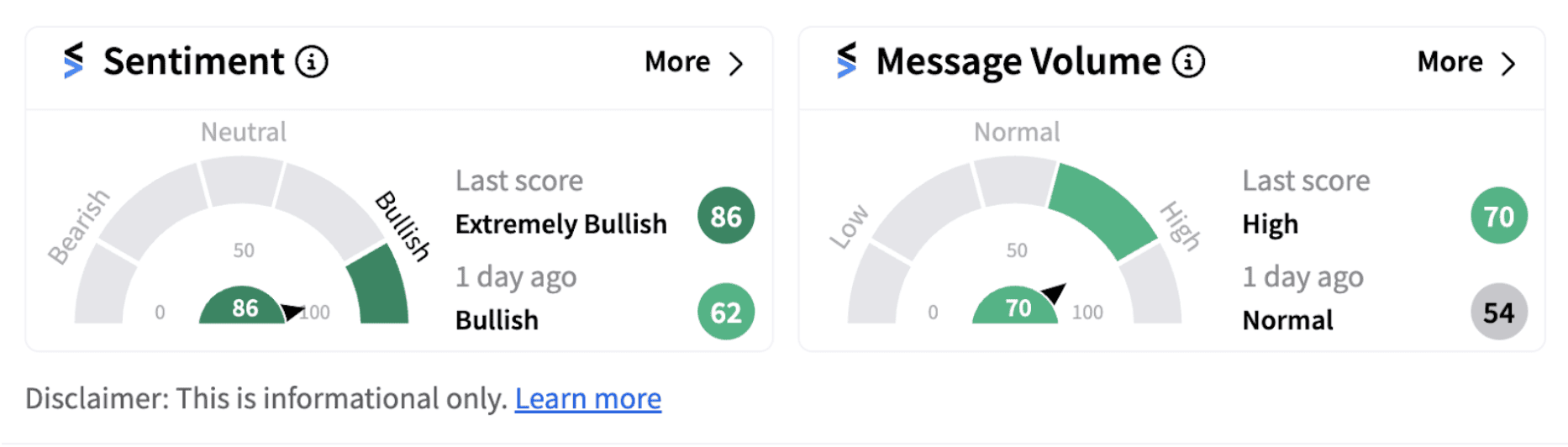

Following the reports, retail sentiment for Intel on Stocktwits jumped into the ‘extremely bullish’ territory (86/100) from the ‘bullish’ zone a day ago.

Intel has announced some intense cost-cutting measures that would involve a 15% reduction in its workforce coupled with dividend suspension. The turnaround exercises come at a time when the firm failed to capitalize on the AI boom like some of its peers like Nvidia (NVDA) and AMD did.

CEO Pat Gelsinger recently announced the company’s plans to establish Intel Foundry as an independent subsidiary inside of the company.

Intel believes such a subsidiary structure will unlock important benefits, most importantly, providing future flexibility to evaluate independent sources of funding and optimize the capital structure of each business to maximize growth and shareholder value creation.

The chipmaker is also implementing plans to reduce or exit about two-thirds of its real estate globally by the end of the year and is selling part of its stake in Altera, the firm’s programmable chip business.

With all revamp exercises already under way, some Stocktwits users are wondering whether a takeover of Intel will lead to more job losses.

https://stocktwits.com/Timefortendies77/message/586827399

Others believe that the stock is likely to gain given the immense takeover interest received by the firm.

https://stocktwits.com/Frescaboy/message/586827082

Intel shares have lost over 54% since the beginning of the year. In the same period, Nvidia shares have gained over 140% while AMD stock has risen over 12%.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2195880631_jpg_5d50833996.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227553102_jpg_9cb79c1b5b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2236688965_jpg_b00d009983.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2231423801_jpg_f64bcdbb33.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2242062032_jpg_b5e44cfa75.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Trade_desk_logo_resized_c0229eb2ab.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)