Advertisement|Remove ads.

Intel’s Recovery In Motion, But Skeptics Remain: Retail Investors Weigh In On Chipmaker’s Future

Intel Corp. (INTC), once a dominant force in the semiconductor industry, is having a rough year. Despite being one of the worst performers on the S&P 500 in 2024 — down about 60% — the company’s stock has shown signs of life, gaining over 3% this past week.

Intel’s struggles can be traced back to missing out on the artificial intelligence (AI) boom, a space where competitors like Nvidia and AMD surged ahead. Now, for the third consecutive year, the company is facing shrinking sales. However, a few positive developments have breathed some life back into the stock.

Earlier this month, Bloomberg reported that Intel is exploring options for its stake in Mobileye Global (MBLY), its automated driving systems subsidiary, which has been underperforming. If Intel decides to sell its stake, it could inject much-needed cash into the business.

Bloomberg on Friday reported that Intel has officially secured up to $3.5 billion in federal grants to manufacture semiconductors for the Pentagon under the highly secretive “Secure Enclave” program, aimed at producing advanced chips for military and intelligence use.

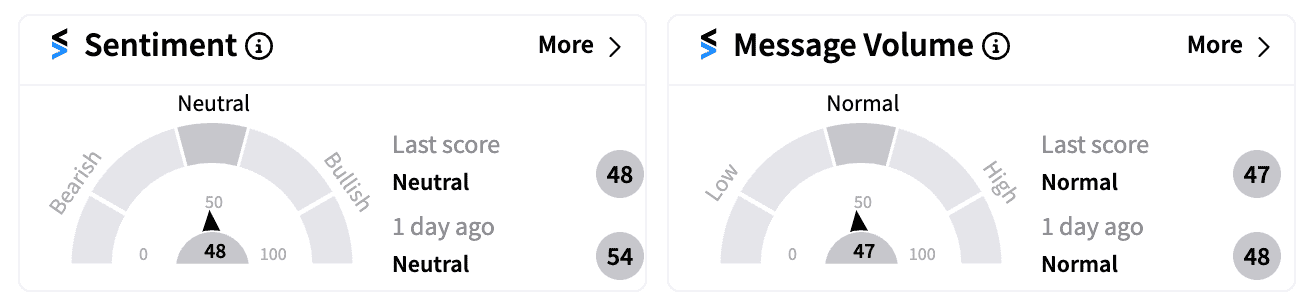

Retail sentiment on platforms like Stocktwits remained ‘neutral’, reflecting a cautious optimism.

One ‘bullish’ investor posted, “The US Government does not gamble with national security. The success of Intel is considered a top national security initiative,” citing the company’s cutting-edge AI chips like Lunar Lake and Arrow Lake.

Another user said that Intel’s latest cash influx under the Chips and Science Act — which includes $8.5 billion in grants and $11 billion in loans — signifies the company is “too big to fail,” though it still has a long way to go in proving itself.

Not all investors are convinced. A Reuters report on Monday revealed that Intel lost a lucrative contract in 2022 to AMD and TSMC to design and fabricate Sony’s next-generation PlayStation 6 chip.

While this blow to its contract manufacturing unit was downplayed by many, some skeptics remain focused on the fundamentals.

As one bearish user put it, “This loser of a stock could get a $10 billion infusion and still go red on the day.”

Intel faces steep challenges ahead, as it recently missed earnings expectations by a wide margin and presented a dour near-term outlook.

Analysts have highlighted execution risks in its product portfolio and continued market share losses.

Regaining its lost leadership in the chip sector will require not just cash infusions but meaningful innovation and flawless execution.

Read next: Children’s Place Stock’s Retail Sentiment Crashes Amid Short Interest Surge And Post-Earnings Rally

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2231423801_jpg_f64bcdbb33.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2242062032_jpg_b5e44cfa75.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Trade_desk_logo_resized_c0229eb2ab.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2230137825_jpg_d14459f501.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2217651250_jpg_908ef236f4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2194622714_jpg_c18475d557.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)