Advertisement|Remove ads.

Intel Rallies 9%, It Is Already Up Near 100% In Past 6 Months – What Is Retail Saying?

- At the ongoing CES event, Intel unveiled its Intel Core Ultra Series 3 processors, its first AI PC platform built on Intel’s 18A process technology.

- It also unveiled Panther Lake processors, which is the first high-volume product built on the 18A process.

- Shares were up more than 9% on Wednesday Morning.

Intel shares have gained nearly 100% in the past six months, and it continued to rally on Wednesday making it one of the top trending stocks on Stocktwits.

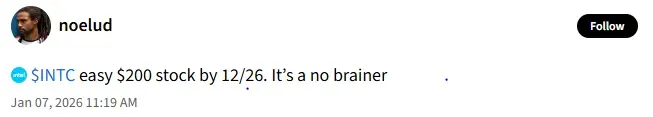

Some investors expect the current rally to continue and shares to reach $200 mark by the year-end, while others hailed its recent announcements around series 3 processors during the ongoing CES event in Las Vegas.

The retail investors are buoyed on the stock as they expect the recent unveiling of its Intel Core Ultra Series 3 processors, the first AI PC platform built on Intel 18A process technology as well as its Panther Lake AI chips that also utilize the advanced 18A process will give back Intel its lost technological edge over its rivals it once had.

What Are Stocktwits Users Saying?

On Stocktwits, retail sentiment around Intel stock has remained in the ‘extremely bullish’ territory amid ‘high’ message volumes.

One bullish user noted that momentum in Intel remains intact. Further adding that institutions like Vanguard, BlackRock, Geode, UBS, State Street, and Virtu are maintaining or increasing their exposure in the company stock, signals confidence.

One user said that a new CEO change was needed for the company.

Another user hailed the latest CES news by saying that it is the first real evidence that Intel's foundry business can compete at the highest level with TSMC.

https://stocktwits.com/LakersandVRX/message/641084807

One user said it sees the stock as ‘undervalued’.

CES Updates

At the ongoing CES event, Intel unveiled its Intel Core Ultra Series 3 processors, its first AI PC platform built on Intel’s 18A process technology that was designed and manufactured in the United States. The company announced that consumer orders for the first consumer laptops powered by Intel Core Ultra Series 3 processors will begin Jan. 6, 2026. Systems will be available globally starting Jan. 27, 2026, with additional designs coming throughout the first half of the year.

This is Intel’s first real attempt to convince investors and its customers about its next-generation manufacturing capability, known as 18A. It also unveiled Panther Lake processors, which is the first high-volume product built on this process.

Intel has lost ground in chipmaking to rivals like Advanced Micro Devices and Taiwan’s chip giant TSMC. The U.S. government has acquired a 10% stake in Intel, as it attempts to bolster President Donald Trump’s attempt to make more chips in the country.

Street Action

Earlier, an analyst at Melius Research upgraded Intel to ‘Buy’ from ‘Hold’ and assigned a $50 price target.

Analyst said that recent news on Nvidia (NVDA) testing the 18A process node and didn't like it was "stale”. He added that he sees "a good chance" that Nvidia and Apple (AAPL) will "take a hard look" at producing chips on the 14A node by 2028/2029. Analyst expects the news could fully filter into the stock going throughout 2026, driving higher book value, as per TheFly.

Shares of Intel have jumped more than 110% in the past year.

/filters:format(webp)https://news.stocktwits-cdn.com/large_arthur_hayes_OG_jpg_734ff95af6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1247400381_jpg_765e6ec016.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_strategy_logo_OG_jpg_fa4e1a7d04.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2206312585_jpg_1a7c050dff.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227669377_jpg_9a115c3623.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2232490693_jpg_6d25778555.webp)