Advertisement|Remove ads.

Intel Drops 8% Pre-Market Amid Fears of Dow Exit After 25 Years: Is Retail Sentiment Shaken?

Shares of Intel Corp (INTC) fell over 8% in Wednesday’s pre-market trading as investors began worrying about the stock losing its position from the Dow Jones Industrial Average in the backdrop of a significant slump in its share price. Intel shares are down almost 58% on a year-to-date (YTD) basis.

Investor concerns about the stock potentially losing its status as a Dow member are notable, considering the company was one of the first technology firms to join the index in 1999.

Reuters cited analyst Ryan Detrick, chief market strategist at the Carson Group stating that Intel being removed was likely a long time coming.

Intel fell out of favor with investors as peers such as Nvidia and AMD capitalized on the AI boom, while it struggled to keep up. Disappointing earnings further worsened sentiment.

Latest reports indicate CEO Pat Gelsinger and other key executives are set to present a plan to the board that includes cutting costs and trim capital spending.

The plan reportedly consists of selling off businesses that can no longer be funded by the firm’s profits. One of the units that could potentially be sold off includes the firm’s programmable chip business Altera which was acquired in 2015 for $16.7 billion.

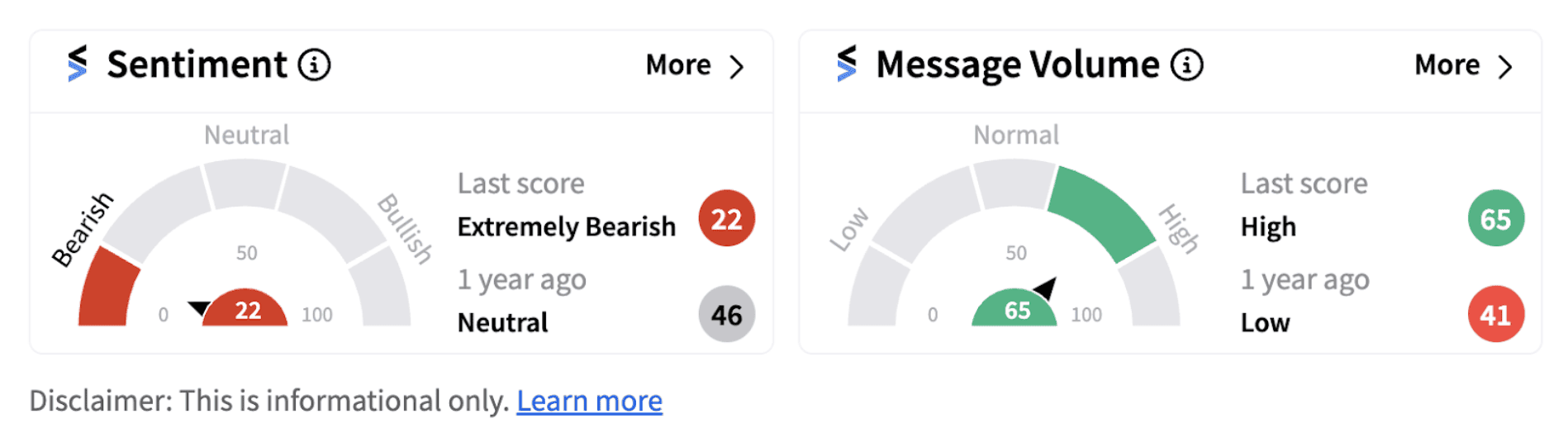

Amidst these developments, retail sentiment on Intel touched a one-year low, with the sentiment meter flipping into the ‘extremely bearish’ territory (22/100). The move was accompanied by high message volume.

Gelsinger’s proposal is likely to be presented at the firm’s board meeting in mid-September, according to the report. Apart from trimming off businesses, another plan includes trimming down its capital spending. A source told Reuters that the plan may also include evaluating a pause or completely stopping the firm’s $32 billion factory in Germany.

Intel is in the midst of a $10 billion cost reduction plan aimed at increasing efficiency and market competitiveness. The actions include structural and operating realignment across the company, headcount reductions (over 15%), and operating expense and capital expenditure reductions of more than $10 billion in 2025.

Meanwhile, Reuters also reported that Intel’s contract manufacturing business witnessed a setback after tests conducted by Broadcom failed and the firm concluded that the manufacturing process is not yet viable to shift into high-volume production.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1231054004_jpg_b9d2302b85.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2153247585_jpg_571ebe2844.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_US_China_trade_standoff_jpg_46acfddb14.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://images.cnbctv18.com/uploads/2024/04/syngene-international1-2024-04-7c6499e2d3ae14d79b2cc8264c5ebea2.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/cnbctv18logo.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bulls_versus_bears_stock_market_jpg_c083ddc168.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2238160824_jpg_d18c8fe07a.webp)