Advertisement|Remove ads.

Invivyd Stock Hits 19-Month High As Public Offering Lands Days After Point72, Janus Henderson Reveal Big Stakes

- The company launched an underwritten public stock offering, granting underwriters a 30-day option to buy additional shares.

- Invivyd said proceeds will support preparation for a potential VYD2311 launch and broader pipeline development.

- Recent filings showed the firm posted higher Q3 revenue and a sharply narrower quarterly net loss.

Invivyd, Inc. shares surged to a 19-month high on Monday after investors welcomed the company’s move to launch a public stock offering, following fresh ownership filings from Point72 and Janus Henderson.

The stock rose 21% to $2.84 on Monday, extending the prior session’s rally after the stake disclosures, which had driven the stock to its strongest one-day gain in nearly three months. However, shares slipped 8.6% in after-hours trade.

Public Offering Announcement

Invivyd said it had launched an offering of its common stock and would grant underwriters a 30-day option to purchase up to an additional 15% of the shares sold. Cantor is serving as the sole book-running manager.

The company said it intends to use proceeds, together with existing cash, to prepare for a potential launch of VYD2311, its investigational monoclonal antibody designed for the prevention and treatment of COVID-19. Proceeds will also support research and development across programs, including RSV and measles, advance its SPEAR study group focused on monoclonal antibody therapy in Long Covid and Covid-19 post-vaccination syndrome, and fund general corporate purposes.

Large Stake Filings Released Last Week

Point72 Asset Management and CEO Steven A. Cohen disclosed beneficial ownership of 9.7%, representing 20.37 million shares, while Janus Henderson Group reported a 12.1% position totaling 25.38 million shares. Both filings listed shared voting and dispositive power over their holdings.

Q3 Review

Invivyd reported third-quarter (Q3) revenue of $13.1 million, up from $9.3 million a year earlier, and a net loss of $10.5 million, compared with $60.7 million a year ago. Loss per share narrowed to $0.06 from $0.51.

For the nine months to Sept. 30, revenue rose to $36.2 million from $11.6 million, while net loss narrowed to $41.4 million from $151.5 million, with loss per share improving to $0.30 from $1.28.

Antibody Activity And FDA Guidance

In August, Invivyd said its monoclonal antibodies pemivibart and VYD2311 continued to neutralize the emerging XFG COVID-19 variant in laboratory tests. The company also reported activity against circulating variants NB.1.8.1, LF.7.9, and LP.8.1, and said it identified no resistant strains.

The company also said it had reached alignment with the FDA on a streamlined regulatory pathway for VYD2311. Following a Type C meeting, the agency advised that a single Phase 2/3 randomized, placebo-controlled trial with a modest number of symptomatic COVID-19 cases could support a biologics license application. Invivyd had said it would test two doses and has a clinical supply on hand.

Stocktwits Traders Brace For Larger Deal Terms

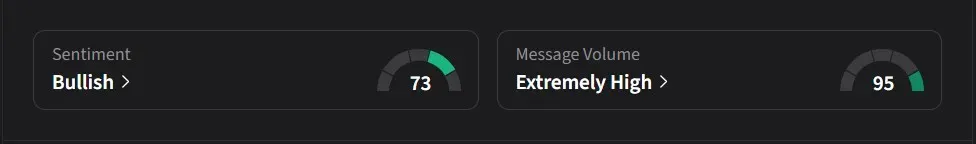

On Stocktwits, retail sentiment for Invivyd was ‘bullish’ amid a 9,000% surge in 24-hour message volume.

One user said they were holding their short and expected a large offering once the company releases the updated prospectus with the final deal terms.

Another user said the fundraising made sense, adding that bigger gains might come in 2026 and questioning the offer price.

Invivyd’s stock has surged by more than 540% so far in 2025.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262606802_1_jpg_86ff244e32.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2250929484_jpg_8206df84ab.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2215390052_jpg_84ddd1faac.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2177851484_jpg_b969f68c05.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2158238458_jpg_48ab7af27c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Rocketlab_resized_jpg_92c1a02a7f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)