Advertisement|Remove ads.

IonQ Stock Stokes Retail Optimism After Receiving Necessary Clearances For Oxford Ionics Acquisition: Retail Sees ‘Multitrillion Dollar Market Company’

Shares of IonQ (IONQ) rallied 4% higher in the pre-market session on Monday after the company secured UK Investment Security Unit regulatory clearance for the acquisition of Oxford Ionics.

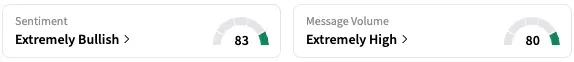

IONQ shares closed up 18% higher on Friday after the company announced that all conditions for the deal have been satisfied, and it now looks forward to closing the deal in the near term. On Stocktwits, retail sentiment stayed within the ‘extremely bullish’ territory over the past 24 hours, while message volume jumped from ‘normal’ to ‘extremely high’ levels.

A Stocktwits user expressed optimism for the CEO building a “multitrillion dollar market company.”

Another said that they would continue buying shares of the company until it reaches $200.

IonQ entered into a definitive agreement to acquire Oxford Ionics in a transaction valued at $1.075 billion in June. The transaction will consist of $1.065 billion in shares of IonQ common stock and approximately $10 million in cash, the company stated, adding that the deal will bring together IonQ’s quantum computing, application, and networking stack with Oxford Ionics’ ion-trap technology, which is manufactured on standard semiconductor chips. The transaction is expected to close this year.

Cantor Fitzgerald on Monday raised its price target on IonQ to $60 from $45 while keeping an ‘Overweight’ rating on the shares. The analyst noted that it has a positive view about the company's roadmap to commercializing quantum computing and their potential leadership in the sector.

B.Riley also raised its price target on IonQ to $75 from $61 while keeping a ‘Buy’ rating. The firm believes IonQ is “far better positioned” than the stock currently reflects.

IONQ stock is up by 33% this year and by about 611% over the past 12 months.

Read also: Why Is XPeng Stock Rising Pre-Market Today?

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2203138957_jpg_dd735f9905.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_lumen_technologies_logo_resized_jpg_29f9980341.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_circle_logo_original_jpg_93ebf851f7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2230137825_jpg_d14459f501.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2212184506_jpg_fda8936683.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Novo_Nordisk_jpg_96dd19f953.webp)