Advertisement|Remove ads.

IRFC Gains On Earnings Beat: SEBI RA Spots Technical Strength, Recommends Buy

Indian Railway Finance Corporation (IRFC) shares gained nearly 3% on Wednesday, driven by strong performance in its June quarter earnings (Q1 FY26).

The government-owned railway financial company reported a year-on-year (YoY) net profit increase of 10.7% at ₹1,746 crore, while revenues grew by 2.2% to ₹6,915 crore. Its finance costs decreased by 0.6% YoY to ₹5,124 crore.

IRFC further improved its debt-to-equity ratio to 7.44, signaling a stronger balance sheet. The company also maintained a zero non-performing assets (NPA) ratio, reflecting its stable financial position.

Additionally, its net worth rose to ₹54,423.96 crore, and its book value per share climbed to ₹41.65, indicating robust capital strength.

Technical Trends

SEBI-registered analyst Prabhat Mittal noted that IRFC stock has corrected almost 50% from July 2024 to March 2025. Since then, the stock has consistently formed higher tops and bottoms, which is a positive sign for the stock.

Mittal added that in the last one year, IRFC has resisted multiple times at its 100-day moving average (DMA). Currently, it is taking support at this level after having breached it.

He advised that traders can consider buying this stock at its current price of ₹134, with a strict stop-loss of ₹129, targeting ₹143 and ₹148.

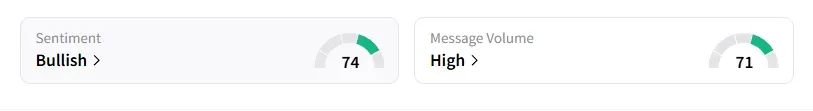

Data on Stocktwits shows that retail sentiment has been ‘bullish’ on this counter for a week amid ‘heavy’ message volumes.

IRFC shares have declined 10% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262712431_1_jpg_6f471d2542.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_pharma_stock_jpg_490939e580.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1449195267_jpg_c8a3db2d5b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_coinbase_new_jul_2eaf8eb2ac.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ardelyx_jpg_488a3f8312.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_jpg_eb6402d336.webp)