Advertisement|Remove ads.

Jagsonpal Pharma’s Rally Faces Litmus Test At ₹320; SEBI RA Vijay Gupta Cautions Supply Zone May Stall Momentum

Jagsonpal Pharmaceuticals, a healthcare company focused on gynecology, dermatology, pediatrics, and orthopedics, has seen a stellar run in the last five sessions,, with its shares rallying 11%. However, the stock is facing stiff resistance between ₹300 and ₹320.

On Tuesday, Jagsonpal Pharma shares faced rejection near ₹298 - ₹300, an area which has historically acted as a strong supply zone, marked by sharp sell-offs and distribution, noted SEBI-registered analyst Vijay Kumar Gupta.

However, the overall structure remains bullish with a series of higher highs and higher lows, Gupta said.

For a sustained move higher, a daily close above ₹320, supported by volume, would confirm a breakout and potentially open the path to fresh upside levels. Until then, price action in this resistance band should be watched closely for signs of reversal or consolidation, the analyst added.

On the downside, immediate support lies in the ₹250 - ₹260 range, which has previously acted as a breakout base. The analyst believes that the first support should act as an ideal re-entry zone for aggressive swing traders.

Further support is seen at ₹200 - ₹225, a historically strong bullish order block, and at ₹140–₹160, a long-term accumulation zone aligned with past earnings reactions.

While the bullish trend is intact, Jagsonpal faces a crucial resistance hurdle. Failure to hold above ₹275 may shift the trend to sideways or weaken short-term momentum, he added.

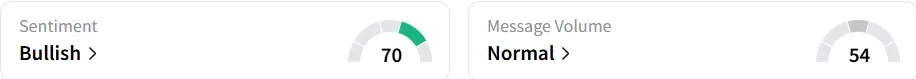

Retail sentiment on Stocktwits slid to ‘bullish’ from ‘extremely bullish’ a day earlier.

The closed marginally higher at ₹287.99 on Tuesday, having lost more than 55% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_912727778_jpg_3bd44c57ad.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1235943608_jpg_91702ef0ab.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_167578473_jpg_29255f031f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Michael_Burry_jpg_fa0de6ac92.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_winklevoss_1c7de389e0.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_altcoins_5a22b361ff.webp)