Advertisement|Remove ads.

James Hardie Q4 Earnings Preview: Demand Outlook, AZEK Deal In Focus — Retail’s Bullish

James Hardie Industries (JHX) stock has gained 0.4% over the past week ahead of its quarterly earnings report on Tuesday.

According to FinChat data, Wall Street expects the cement maker to report fourth-quarter (Q4) earnings per share of $0.36 on revenue of $983.9 million. The company has topped market expectations three out of the previous four quarters.

The earnings report would be the first since the company announced a $8.75 billion deal to acquire rival AZEK in March. The offer price was a 37% premium compared to the stock’s closing price on March 21, leading to some investors baulking at the valuation.

Following a selloff on fears of equity dilution, several brokerages said the deal made sense in the longer term and would positively impact earnings from fiscal 2027.

According to The Fly, BofA analysts noted that James Hardie remains the "best-in-class company with significant moat given high-quality products."

Investors will also consider the outlook provided by the top fibre cement maker amid continued weakness in the housing market.

A National Association of Home Builders survey earlier this month reported that sentiment among single-family homebuilders hit a one-and-a-half-year low in May as developers struggled to fix prices amid uncertain raw material prices.

U.S. President Donald Trump’s whipsawing trade policy has also dampened homeowners’ interest in acquiring a new house.

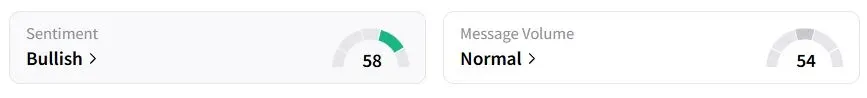

Retail sentiment on Stocktwits was in the ‘bullish’ (58/100) territory, while retail chatter was ‘normal.’

James Hardie stock has fallen 18.8% year to date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1549425533_jpg_483afd6d69.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_down_resized_901c19c371.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2235778544_jpg_2b7ceca102.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_hawaiian_electric_resized_4b766fd741.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2230137825_jpg_d14459f501.webp)