Advertisement|Remove ads.

James Hardie Slips After Q4 Revenue Miss, CEO Warns Of Possible Volume Decline In North America: Retail’s Bullish

James Hardie Industries (JHX) stock fell 1.9% in extended trading on Tuesday after the company’s fourth-quarter revenue fell short of Wall Street’s expectations.

According to Koyfin data, the company reported revenue of $971.5 million for the quarter ended March 31, which missed estimates of $983.9 million.

The top fiber cement producer’s adjusted earnings of $0.36 per share for the final quarter of the fiscal year were in line with estimates.

Earlier in the day, building products supplier Eagle Materials saw its worst day since the COVID-19 pandemic after its fiscal fourth-quarter earnings missed Wall Street’s estimates.

James Hardie said that net sales in its North American fiber cement segment fell by 2% while volumes declined by 3% due to continued market weakness, particularly in multi-family housing. It was partially offset by efforts to gain share in single-family new construction and repair &

remodel.

The company has signed exclusive supply agreements with several home builders over the past few months. It also agreed to acquire peer AZEK for $8.75 billion in March.

The company warned that broader macroeconomic uncertainty could further impact the cost of home construction, weigh on consumer sentiment, and influence demand.

While lower mortgage rates encouraged buyers to acquire new homes in February and March, Donald Trump’s tariff policies have dampened consumer sentiment.

“North America, which represents approximately three-quarters of our total net sales, we are prudently planning for market volumes to contract in fiscal year 2026, including a fourth consecutive year of declines in large-ticket repair & remodel activity,” CEO Aaron Erter said.

The company forecasted North America sales to grow by low single-digit percentage points in fiscal 2026.

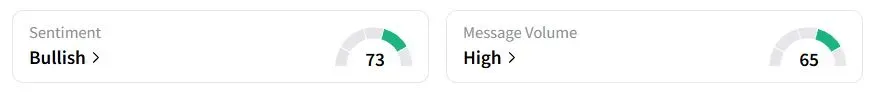

Retail sentiment on Stocktwits was in the ‘bullish’ (73/100) territory, while retail chatter was ‘high.’

James Hardie stock has fallen 20.4% year to date (YTD).

Also See: Chevron Stock In Spotlight After Reports Say US To Extend Venezuela License

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2254648547_jpg_a843db78b6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1000648682_jpg_6aa61e3574.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259602028_jpg_5b1a490e64.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259775985_jpg_a06a1e88c3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_dogecoin_OG_2_jpg_304df31f25.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_vitalik_buterin_OG_jpg_7ac8ea93fe.webp)