Advertisement|Remove ads.

Janus International Stock Soars 14% On Better-Than-Expected Q4 Earnings, Guidance: Retail’s Unconvinced

Access control technologies and building product solutions provider Janus International Group, Inc. (JBI) shares surged 14% on Wednesday, heading toward their best single-day performance since November 2022, after the company reported its fourth-quarter earnings.

JBI reported a 12.5% year-over-year (YoY) decline in its fourth-quarter (Q4) revenue to $230.8 million, far exceeding a Wall Street projection of $185.19 million.

Segment-wise, Self-Storage revenues fell 17.3%, while Commercial and Other revenues declined 1.0%. The company noted that the asset acquisition of TMC contributed $9.5 million to revenue for the fourth quarter.

Adjusted earnings per share (EPS) stood at $0.05 compared to an estimated $0.02.

CEO Ramey Jackson said that despite the difficult market conditions that unfolded during 2024, the company remains confident in its long-term value proposition and believes the fundamentals driving the industry remain intact.

“As we look ahead to 2025, we continue to invest in the business to build resilience and deliver market-leading products and services to our customers,” Jackson said.

For 2025, the company expects revenue in the range of $860 million to $890 million, while analysts expect revenue of $849.78 million, according to FinChat data. Adjusted earnings before interest, tax, depreciation, and amortization (EBITDA) is expected to hit $175 million to $195 million during the year.

JBI also reaffirmed its long-term financial targets and expects non-GAAP annual organic revenue growth in the range of 4% to 6% while the adjusted EBITDA margin is expected at 25% to 27%.

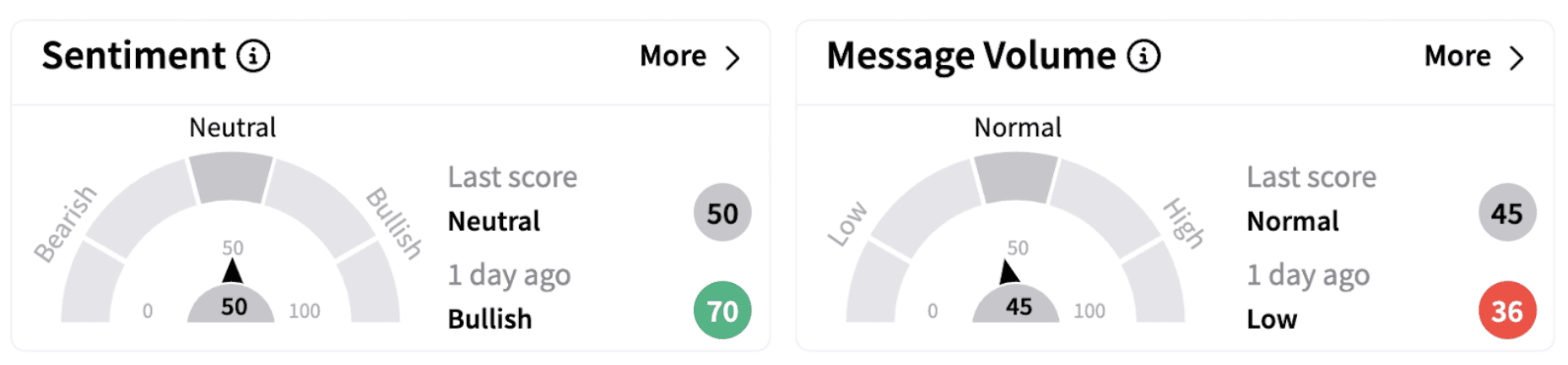

On Stocktwits, retail sentiment inched lower into the ‘neutral’ territory (50/100) from ‘bullish’ a day ago.

JBI shares have gained over 23% this year but are down over 38% over the past year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Jane_Street_3ac3fb6443.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Truth_social_5bfbc7389b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2221283194_jpg_8178c730a4.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Morgan_Stanley_HQ_logo_5431c7f2ad.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1549425533_jpg_483afd6d69.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_down_resized_901c19c371.jpg)