Advertisement|Remove ads.

JB Hunt Stock Draws Retail Eyeballs On Several Price Target Cuts After Q1 Earnings, Retail’s Bearish

J.B. Hunt Transport Services (JBHT) stock gained retail attention after brokerages trimmed their price targets after its first-quarter earnings.

The logistics firm’s first-quarter revenue fell 1% to $2.92 billion compared to a year earlier, hurt by 13% fewer loads in Integrated Capacity Solutions, among other factors.

Its net earnings fell to $1.17 per share for the three months ended March 31, compared to $1.22 per share, in the year-ago quarter.

“We believe they (tariffs) have the potential to impact both supply and demand, but the magnitude and timing are difficult to predict,” a company executive said on a call with analysts.

According to The Fly, BMO Capital cut the firm's price target on J.B. Hunt to $175 from $200.

The brokerage noted that while Q1 results were slightly better than expected, it is lowering the price target due to elevated macro uncertainty and the potential downside risk to intermodal volumes amid shifting trade policies.

Goldman Sachs slashed the stock's price target by $1 to $164. The brokerage noted that it was prudent to reduce the company's Integrated Capacity Solutions segment margin for the second half of 2025 to better align with the weaker second-half operating environment.

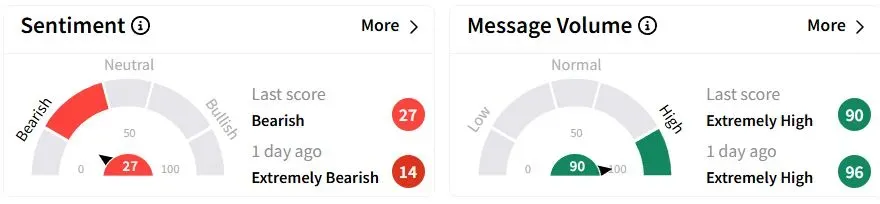

Retail sentiment on Stocktwits was in the ‘bearish’(27/100) territory, compared to ‘extremely bearish’ a day ago, while retail chatter was ‘extremely high.’

One retail trader dubbed the company’s conference call “horrible”, with no assurance for growth during the question-and-answer session.

JB Hunt shares have fallen 27.6% year-to-date (YTD).

Also See: Equinor’s New York Offshore Wind Project Paused As Trump Administration Orders Further Review

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2261740483_jpg_28cc9c7ce9.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_adam_smigielski_K5m_Pt_O_Nmp_HM_unsplash_f365ee93f4.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250929477_jpg_725f832b99.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250993932_jpg_77e7b26c88.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_tesla_cybertruck_jpg_7f6ed70b80.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Workday_logo_resized_d2d5258f05.jpg)