Advertisement|Remove ads.

Jefferies Downgrades DoorDash To ‘Hold,’ Retail Remains Skeptical

Jefferies downgraded food delivery firm DoorDash’s (DASH) rating to ‘Hold’ from ‘Buy’ on Tuesday, despite the company's solid execution and good core profit growth, as the firm believes the strength may already be reflected in the current valuation.

DoorDash shares fell nearly 1% to $240.52 during premarket trading on Tuesday. Jefferies raised its price target to $250 from $235, according to TheFly.

The concern lies in the need to apply “optimistic multiples” to DoorDash’s non-core businesses, such as advertising, grocery delivery, and international expansion, according to analyst John Colantuoni.

While these areas show potential, they may not yet warrant the lofty valuation premiums being assigned, he added.

The company said in May it would buy U.K.’s Deliveroo in a deal valuing the British rival at about 2.9 billion pounds or $3.90 billion at the time of writing. This move is a part of its international expansion plans and to take on competition such as Uber Eats and Eat in the region.

DoorDash has also been working to drive revenue growth by attracting consumer goods companies to advertise on its platforms and by expanding its delivery services to include grocery and beauty products.

“In addition, the company's recent ramp in affordability initiatives could limit upside to take rate,” Colantuoni said, viewing the shares fairly valued.

The company is scheduled to post second-quarter results on August 6. It is expected to post revenue of $3.16 billion and profit per share of $1.07, according to data compiled by FinChat.

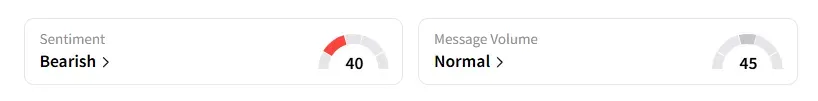

Retail sentiment around the stock was unchanged and remained in the ‘bearish’ territory, compared to a day ago, while message volume was ‘normal,’ according to Stocktwits data.

DoorDash shares are up 45% year-to-date and have surged 123% in the last 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Also See: Apple iPhone Shipments Rose 1.5% in Q2, China Downturn Offset By Growth In Emerging Markets: IDC

/filters:format(webp)https://news.stocktwits-cdn.com/large_LUNR_Intuitive_Machines_resized_jpg_5655032711.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_stock_chart_falling_resized_jpg_c0ce61eff2.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_MSTR_caaa0be909.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1903197985_jpg_2c45018acb.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2203138957_jpg_dd735f9905.webp)