Advertisement|Remove ads.

JetBlue Stock Nosedives As Lowered Revenue Outlook Outweighs Earnings Beat, But Retail Shrugs It Off

Shares of JetBlue Airways Corp. ($JBLU) plunged over 14% as markets opened on Tuesday, despite surpassing earnings estimates for the third quarter. The sharp decline follows the airline's anticipation of falling revenue in the coming months.

The budget airline reported losses of $0.16 per share, better than the forecasted loss of $0.21. Revenue reached $2.37 billion, slightly above the consensus estimate of $2.36 billion, according to Stocktwits data.

The company noted that trends observed in the third quarter have continued into the fourth quarter, allowing JetBlue to expect positive revenue growth after factoring in the effects of Hurricane Milton and the upcoming 2024 election.

Despite its optimism, JetBlue still expects fourth-quarter revenue to decline by 3% to 7% compared to the same period last year.

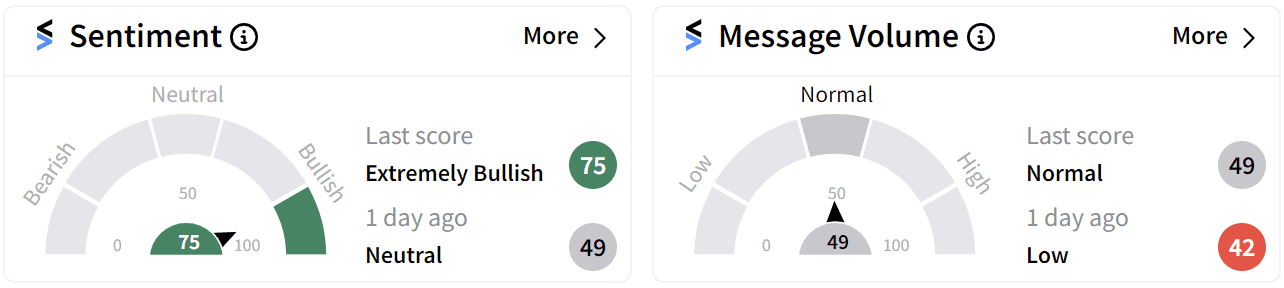

Although revenue expectations have been downgraded, JetBlue's retail sentiment on Stocktwits has soared to ‘extremely bullish’ (75/100), a significant jump from a neutral rating the previous day.

Investors appear to be enthused by the improvement in JetBlue’s full-year guidance. The company has revised its revenue growth forecast to a decrease of 5% to 4%, improved from a decline of 6% to 4%.

It also lowered its fuel price estimate to $2.75 to $2.80 per gallon, down from $2.80 to $3.00.

As a result, the expected capacity growth is now a decline of 4.5% to 2.5%, better than the previous decline forecast of 5% to 2.5%.

JetBlue said it would further promote seats with extra legroom as it looks to compete in the premium leisure segment and that it remains on track to hit its full-year targets.

The stock has gained 19% so far in 2024, and 50% in the last 12 months.

For updates and corrections email newsroom@stocktwits.com.

/filters:format(webp)https://images.cnbctv18.com/uploads/2025/04/rich-money-2025-04-f0b4073db42c6bc97979f963f46d5013.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/cnbctv18logo.png)

/filters:format(webp)https://images.cnbctv18.com/uploads/2024/03/filter-coffee.jpg)

/filters:format(webp)https://images.cnbctv18.com/uploads/2024/08/sbi-2024-08-3d512e93ea6e88c29c9d7f4713260a92.jpg)

/filters:format(webp)https://images.cnbctv18.com/uploads/2025/10/metal-and-mining-2025-10-7f1cf8d6ed7a5d31e2971be9b93f8539.jpg)

/filters:format(webp)https://images.cnbctv18.com/uploads/2025/10/2025-10-24t181332z-2012779548-rc2hihawafmm-rtrmadp-3-grindr-m-a-2025-10-eb89b2d5d1b2c7ee27da768ccd3a2e66.jpg)

/filters:format(webp)https://images.cnbctv18.com/uploads/2025/10/jane-2-2025-10-0cb531b3a4a4595817838ded781057b1.jpg)